US Shale Revolution Yields New World Order

In this newsletter:

1) Hail Shale: OPEC Is Losing The Global Oil Game

Financial Post, 11 March 2017

2) Russia’s Rosneft Says OPEC’s Oil Production Cuts May Not Be Extended

OIlPrice, 13 March 2017

3) Oil Bulls Exit Before Market Dive On Swollen U.S. Stockpiles

Bloomberg, 13 March 2017

4) Hedge-Fund Trader Loses Big On Oil Bets That Ignored The Second Shale Revolution

The Wall Street Journal, 13 March 2017

5) Massive Oil Discovery In Alaska Is Biggest Onshore Find In 30 Years

CNN Money, 10 March 2017

6) US Shale Revolution Yields New World Order

Natural Gas Now, 12 March 2017

7) Nick Butler: The Second Shale Revolution

Financial Times, 13 March 2017

8) German Minister Announces End Of Unilateral Climate Targets

Die Welt, 11 March 2017

Financial Post, 11 March 2017

2) Russia’s Rosneft Says OPEC’s Oil Production Cuts May Not Be Extended

OIlPrice, 13 March 2017

3) Oil Bulls Exit Before Market Dive On Swollen U.S. Stockpiles

Bloomberg, 13 March 2017

4) Hedge-Fund Trader Loses Big On Oil Bets That Ignored The Second Shale Revolution

The Wall Street Journal, 13 March 2017

5) Massive Oil Discovery In Alaska Is Biggest Onshore Find In 30 Years

CNN Money, 10 March 2017

6) US Shale Revolution Yields New World Order

Natural Gas Now, 12 March 2017

7) Nick Butler: The Second Shale Revolution

Financial Times, 13 March 2017

8) German Minister Announces End Of Unilateral Climate Targets

Die Welt, 11 March 2017

Full details:

1) Hail Shale: OPEC Is Losing The Global Oil Game

Financial Post, 11 March 2017

Jesse Snyder

The prospect of rising US shale production threatens to undermine the efforts of OPEC, which now looks at risk of having ceded market share for no substantial price gain.

The feeling of restrained optimism that imbued a major energy conference last week was short-lived.

Oil and gas executives in Houston for CERAWeek, an annual conference that draws thousands of energy professionals, expressed confidence in their ability to drive down operating costs to counter lower commodity prices.

The mood, though still cautious, was much lighter than a year earlier when prices were hurtling toward US$30 per barrel.

Now, it seemed, oil markets had entered a period of relative stability amid output declines in some regions.

But on Wednesday, as if in cruel jest, oil prices took their steepest single-day dive in months.

Higher-than-expected inventory data in the U.S. helped push down futures contracts for West Texas Intermediate by five per cent, settling at a 2017 low of US$50.28. On Thursday prices dipped below the US$50 threshold, wiping out hopes that an agreement by OPEC and non-OPEC countries to curb supplies had put a “floor” on prices above the US$40 range.

The drop in prices underscored the seemingly endless uncertainty that has hobbled the industry in recent years, causing companies to dramatically reorient their corporate structures.

“You have to put a business model in place that embraces the volatility,” said ConocoPhillips Co. CEO Ryan Lance.

“We know what to do when prices are higher—the real question is what do you do when prices are back in the US$40-or-so level.”

The lowering of break-even costs dominated discussion. In particular, executives focused on the economics of oily shale basins in the U.S., where production has boomed in recent years despite stubbornly low prices...

Full story

2) Russia’s Rosneft Says OPEC’s Oil Production Cuts May Not Be Extended

OIlPrice, 13 March 2017

Tsvetana Paraskova

Russia’s oil giant Rosneft sees a lack of will among the main signatories to the OPEC/non-OPEC deal and U.S. shale production as the main risks to a possible extension of the global supply cut deal, a Rosneft spokesman told Reuters on Monday.

“We think that in the long term global oil demand dynamics and reduced investment during the period of ultra low prices will balance the market, but that the risk of a price war resuming remains,” the spokesman said.

OPEC and 11 non-OPEC producers agreed in November to curtail their collective crude oil output by almost 1.8 million bpd between January and June, with OPEC shaving off around 1.2 million bpd, and non-OPEC producers – led by Russia – slashing another 558,000 bpd.

The deal had held prices above $50 per barrel before WTI fell to below $50 a barrel last week for the first time since December. This drop has further increased speculation whether the deal should or would be extended beyond its original expiry date at end-June, given the rise in U.S. shale.

Although OPEC is scheduled to decide on a possible extension in May, estimates and guesses are many, and now Rosneft has expressed its view via emailed answers to questions by Reuters.

Full post

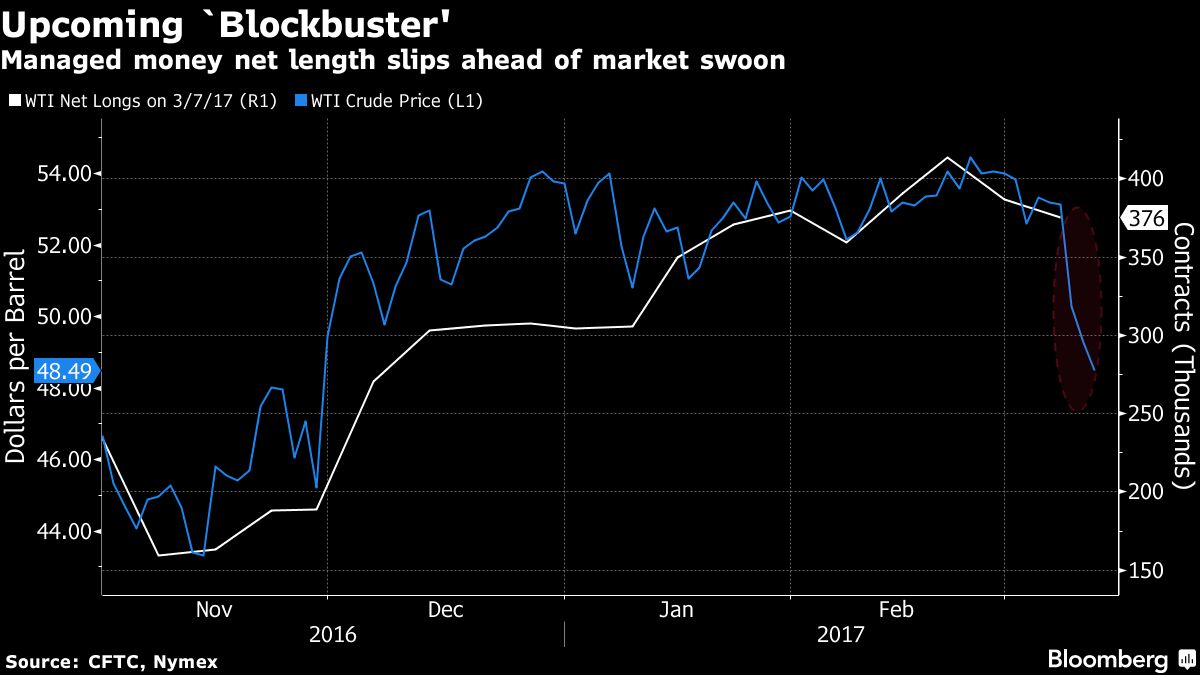

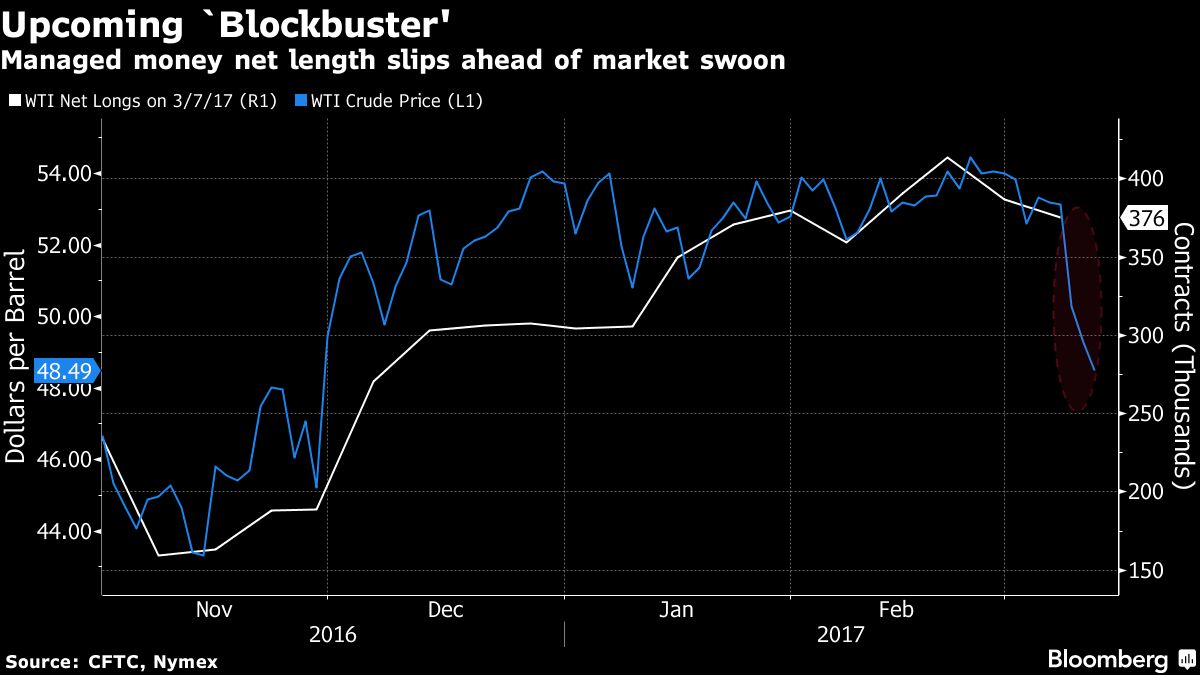

3) Oil Bulls Exit Before Market Dive On Swollen U.S. Stockpiles

Bloomberg, 13 March 2017

Mark Shenk

Oil’s fall from grace last week started with hedge funds, and it may only get worse from here.

Investors cut bullish wagers on West Texas Intermediate crude to a one month-low, according to U.S. Commodity Futures Trading Commission data, a move that came just prior to a market dive that sent prices below $50 a barrel for the first time since December.

"This report is just the beginning," said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. "The volume and breadth of the decline this week show that there was massive liquidation. Next week’s report will be the blockbuster."

Optimism about an agreement between the Organization of Petroleum Exporting Countries and some non-OPEC producers to cut output is fizzling as stockpiles continue to climb and U.S. drilling rigs are returning at the fastest rate since 2012.

The slide in oil prices, which had traded between $50.50 and $55.24 since Dec. 16, helped drag the S&P 500 to its first weekly decline since January. WTI on Monday traded up 0.1 percent at $48.54 a barrel as of 10:46 a.m. in New York.

Full story

4) Hedge-Fund Trader Loses Big On Oil Bets That Ignored The Second Shale Revolution

The Wall Street Journal, 13 March 2017

Laurence Fletcher

Andurand’s Commodities Fund has lost about $130 million in first two months of 2017

Pierre Andurand, one of the world’s best-known oil traders, has suffered a large loss at the start of this year because of wrong-way bets on crude.

Mr. Andurand, who runs the $1.5 billion Andurand Commodities Fund, lost 8.5%, or approximately $130 million, in the first two months of this year, according to numbers sent to investors and reviewed by The Wall Street Journal. The loss makes his fund one of the global hedge-fund industry’s worst-performers in 2017.

A spokeswoman for Mr. Andurand declined to comment.

The France-born trader, who runs his fund out of offices opposite London luxury department store Harrods, gained 22% last year, helped by bullish bets, including buying one day after oil hit a 13-year low last January.

But like many funds, his has been too positive of late, recently forecasting oil would hit $70 a barrel early this year. On Monday, Brent, the global price benchmark, was trading at $51.26 per barrel, while U.S. crude was trading at $48.30 a barrel.

Hedge funds and other big money managers amassed a record number of bullish bets on Brent crude last month, according to the Intercontinental Exchange Inc. That came amid reports that the Organization of the Petroleum Exporting Countries has so far achieved around 90% of the production cuts agreed upon late last year.

But, having traded in a narrow range for most of this year, oil posted its biggest two-day selloff since June last week. Oil inventories in the U.S. have recently hit a record high in a sign that the massive glut that has depressed prices for more than two years is still plaguing the market. The U.S. Energy Department expects American oil production to rebound past 9.7 million barrels a day in 2018, breaking the record output level set in 1970.

Full story

5) Massive Oil Discovery In Alaska Is Biggest Onshore Find In 30 Years

CNN Money, 10 March 2017

Matt Egan

Some 1.2 billion barrels of oil have been discovered in Alaska, marking the biggest onshore discovery in the U.S. in three decades.

The massive find of conventional oil on state land could bring relief to budget pains in Alaska brought on by slumping production in the state and the crash in oil prices.

The new discovery was made in just the past few days in Alaska's North Slope, which was previously viewed as an aging oil basin.

Spanish oil giant Repsol (REPYY) and its privately-held U.S. partner Armstrong Energy announced the find on Thursday, predicting production could begin as soon as 2021 and lead to as much as 120,000 barrels of output per day.

The oil resources lie in a well, called Horseshoe, that's 75% owned by Denver-based Armstrong. Repsol owns the rest of this well.

The discovery is 20 miles south of where the two companies have already found oil in a project known as Pikka. That northern project is already in early development and is 51% owned by Armstrong, which is the operator on both developments.

"The interesting thing about this discovery is the North Slope was previously thought to be on its last legs. But this is a significant emerging find," Repsol spokesman Kristian Rix told CNNMoney.

Of course, this news won't ease rising concern among investors about the stubborn glut of oil in the U.S. There are increasing signs that shale oil producers are preparing to ramp up output after surviving a two-year price war with OPEC.

Full story

6) US Shale Revolution Yields New World Order

Natural Gas Now, 12 March 2017

Tom Shepstone

The US shale gas industry is, with new LNG export capacity, in position to dominate a new world order in energy with benefits for us and emerging nations.

There’s something new and beautiful happening as a result of the US shale gas industry. Our nation is now in position to dominate a new world order in energy with huge benefits to rural America and nations around the world who are emerging from poverty. It’s a story of exports, something we’ve not done so well at it in a very long time. It’s about shale gas produced in Pennsylvania, Ohio and Texas that is being converted to LNG and sold to Egypt, Mexico and Japan. It offers a demonstration of just how important energy infrastructure is to this country if we want to maximize the benefits of the shale revolution.

MARAN GAS ACHILLES (Courtesy: shipspottting.com © lappino)

The story, which is all about a LNG ship (see above) and an energy market that turned around, is told in the Gulf Times (courtesy of Bloomberg). Here are some key excerpts (emphasis added):

The US stands to become the world’s third-largest exporter by 2020, when it’s expected to ship about 8.3bn cubic feet a day of capacity, or 14% of the world’s share, according to London-based consultant Energy Aspects Ltd. That growth is a testament to the power of the shale boom of the last decade, helping to reduce the country’s reliance on foreign energy sources…

Cheniere, which built the Sabine Pass terminal in Louisiana, was the first to ship shale gas abroad. The Houston-based company is now in the process of starting up its third plant and, alone, is expected to own 7% of the world’s export capacity in 2020, according to Energy Aspects…

Prior to the start of US exports last year, Asia and Europe were seen as the likeliest customers. Gas production in Europe is declining as demand grows and, in some cases, countries have expressed a desire to displace pipeline imports from Russia, seeking to diversify their supply at a time of unsettled geopolitics…

However, while analysts and traders watched whether Europe would emerge as a big buyer, Mexico, which already imports the most US gas by pipeline, quickly became the largest importer of shipped-in LNG from the US, followed by Chile. China, South Korea and Japan boosted buying during the winter.

Perhaps the most unexpected customers were in the Middle East, as Jordan, Egypt and the UAE in tankers. Dominion Resources is expected to join the fray as a US exporter by the end of this year, with its Cove Point terminal in Maryland bringing the nation’s export capability to about 3.2bn cubic feet a day, according to Energy Aspects data.

For natural gas, it’s “a new world order” that not only promises to establish the US as the swing provider, but also allows emerging countries to take advantage of low prices, said Ted Michael, an LNG analyst with Genscape.

Egypt, Jordan and Pakistan are already taking advantage of the change by using tankers docked at their shores that are basically floating factories, able to convert chilled fuel shipped into the country back into gas so it could be distributed on their pipelines. Outfitting ships with regasification plants are a third of the cost of building an onshore facility, and can be installed in a quarter of the time.

“The revolution has many moving parts,” Michael said. The broadening of outlets for exported gas could “easily” help boost US gas output by about a third to 100bn cubic feet a day in the next five years, he said.

It’s quite a revolution, indeed, and the exciting part is that economies are being revived at both ends; in rural Pennsylvania and Ohio, for example where gas shipped through Cove Point will be produced, and in places such as Egypt and Pakistan struggling to come into the modern day world where it is consumed. None of this can happen without the pipelines and LNG ports fractivists have so vigorously opposed. They are, as we’ve noted here many times before, povertykeepers. While styling themselves as protectors, they are destroyers. But, the new world order with respect to energy is here. A world needing our inexpensive clean energy will not be denied. It’s too important.

7) Nick Butler: The Second Shale Revolution

Financial Times, 13 March 2017

The oil price is falling again, with the latest drop taking the price in the US below $50 a barrel. Behind the fall is a remarkable story of technical progress which is once again driving up the volume of oil produced from American shale rocks.

It is now almost a decade since the US shale revolution began. From almost nothing production of gas from shale rocks in the country has risen to almost 50bn cubic ft/day at the beginning of this year, according to data from the US Energy Administration. Low-cost convenient gas pushed coal out of the power sector. Instead of importing gas, as many had expected, the US became self-sufficient before becoming an exporter first of coal and then of gas, in both cases weakening already fragile global markets.

The shale revolution extended to oil, lifting US production by 3m barrels a day and forcing the Saudis to try to flood the market in an attempt to drive American producers out of business and maintain their own market share.

The fall in global prices did not have the intended effect. Some US production was cut back at the margin but the main impact of the Saudi policy has been to push the US shale industry into a process of dramatic cost cutting and technical advance. Now the full implications of that are beginning to be obvious: a second shale revolution is underway.

The story is impressive. Costs have been cut to the point where the industry as a whole breaks even at $50 — and in some cases even below that. But, most important, more reserves have been found — particularly of oil. That will be the focus of the second shale revolution and, once again, global markets will be severely disrupted.

After the dip last year, production of oil from shale rocks in the US is increasing again. Estimates for this year range from a net increase of between 400,000 and 800,000 b/d. And 2017 is not a one-off year. The Permian Basin in Texas — the main focus for the new activity — has oil reserves that exceed those of all the largest discovered fields globally, such as Ghawar in Saudi Arabia and Prudhoe Bay in Alaska

That means we can look forward to a strong continuing increase of perhaps as much as 800,000 b/d each year from shale until 2020. That would lift total US oil production by then from 9mb/d per day to around 11m.

Demand growth across the world is unlikely to exceed 1mb/d and could well be less. Extra US supplies will take the lions share of that growth and make it harder to reduce the overhang of stocks that puts a ceiling on prices. Even if Opec and Russia fully respect the quota system they have agreed, developments in America will outweigh their efforts. Opec and the Saudis in particular will have to make more cuts to maintain current prices. [..]

US shale has been the largest single factor affecting the global energy business in the last decade. Expectations have been overturned; prices set in a climate of ever-increasing scarcity and dependence on volatile insecure producing areas have been undermined. Those effects now look likely to continue and will be compounded by the shifts in technology I wrote about last week.

Those who assumed the shale revolution would be killed off by a cyclical downturn in prices have been proved wrong. Instead, we are seeing a structural shift with supply growth exceeding demand. The implications, especially for countries dependent on earning high prices for their exports, are very serious. The net effect is a redistribution of wealth away from producers in favour of consumers. We are in for a long period of instability, driven this time not by scarcity but by plenty.

Full post

8) German Minister Announces End Of Unilateral Climate Targets

Die Welt, 11 March 2017

Daniel Wetzel

Germany has always acted as pioneer and model pupil in climate policy. This role is now coming to an end. Minister of the Chancellery, Peter Altmaier, has denounced climate unilateralism.

Chancellor Angela Merkel and the Minister of the Chancellery Peter Altmaier; photo: Federal Government of Germany/Kugler

“I am not the most weighty, but the most heavy minister in the Cabinet,” the Minister of the Chancellery, Peter Altmaier, said last Friday at an event in the Hotel Adlon: “I have lost weight, but the gap with others was so great that my leadership was not at risk.”

As usual, Altmaier’s ironic treatment of his diet ensured cheerfulness among his listeners. Soon afterwards, however, the relaxed atmosphere in the Berlin Grand Hall turned into excitement.

For the federal Minister for Special Responsibilities promised the assembled business leaders and managers to fulfill a long-cherished wish: Germany’s expensive go-it-alone climatic policies could soon be over for good.

Thundering applause

“I am firmly convinced that the path of national climate targets is wrong,” Altmaier told the participants of the exclusive “Convention on Energy and Climate Policy” organised by the economic council of the ruling Christian Democratic Party (CDU). Although it is “difficult to cancel existing goals,” Altmaier said, in future “European and international targets” would be required.

Altmaier’s words sparked the first thunderous applause of the day — for a good reason: The Federal Government had always played the role of model pupil and “pioneer” in climate policy. For example, when the EU decided to reduce CO2 emissions by 20 percent by 2020, Germany decided to reduce its emissions by 40 percent. When Europe set itself a green energy target of 20 percent, Berlin had to surpass immediately with a national 35 percent target.

Expensive go-it-alone policies of this kind were not only received badly by German industry given that increasing energy prices and green regulations threaten its competitiveness. Environmental economists also criticised again and again that national unilateralism would not save any extra CO2 under the umbrella of the EU’s emissions trading scheme.

False ambition

Even before the UN Climate Conference in Paris at the end of 2015, Germany’s unilateral ambitions had led to controversial discussions. The federal government had argued that it wanted to encourage other nations to follow its lead by adopting equally ambitious CO2 targets. Critics argued that Germany undermined a coherent EU position at the UN Climate Summit, preventing the EU from speaking “with one voice.”

At the meeting of the CDU Economic Council in Berlin, Altmaier — just as EU Energy Commissioner Miguel Arias Canete had done before – aregued for a “level playing field” in Europe, i.e. cross-country rules for investments in energy efficiency and climate targets.

Bursting with anger, Alexander Cerbe, the chairman of Cologne’s utilities company Rheinenergie retorted: If the same investment conditions were so important for EU climate policy, why did Germany always go much further than the rest, Cerbe wanted to know. “You are quite right,” the federal minister replied to everyone’s surprise: He too considered unilateral goals as “the wrong approach.”

Altmaier’s position concurs with the new energy policy “Energy lab 2030″, developed by the CDU’s Economic Council over several months with the assistance of numerous expert committees and presented at their Congress on Friday. “Unilateral national targets for climate protection are counterproductive and should therefore be abandoned,” it says.

Objectives are over-ambitious

The fact that the federal government now seems intend to pursue only targets that are uniform throughout the EU may be due to the gradual realisation that Germany has adopted over-ambitious targets that cannot be achieved.

In its “Energy Concept 2010″, the federal government had decided to reduce carbon dioxide emissions by 40 percent by 2020, twice as much as the rest of Europe. The phasing out of non-CO2-emitting nuclear power plants did not seem to contradict these ambitions.

However, the climate target now proves to be over-ambitious. Among experts, it is certain that the federal government will clearly miss the promise of a 40% reduction in CO2 emissions by the end of the decade.

Translation GWPF

Financial Post, 11 March 2017

Jesse Snyder

The prospect of rising US shale production threatens to undermine the efforts of OPEC, which now looks at risk of having ceded market share for no substantial price gain.

The feeling of restrained optimism that imbued a major energy conference last week was short-lived.

Oil and gas executives in Houston for CERAWeek, an annual conference that draws thousands of energy professionals, expressed confidence in their ability to drive down operating costs to counter lower commodity prices.

The mood, though still cautious, was much lighter than a year earlier when prices were hurtling toward US$30 per barrel.

Now, it seemed, oil markets had entered a period of relative stability amid output declines in some regions.

But on Wednesday, as if in cruel jest, oil prices took their steepest single-day dive in months.

Higher-than-expected inventory data in the U.S. helped push down futures contracts for West Texas Intermediate by five per cent, settling at a 2017 low of US$50.28. On Thursday prices dipped below the US$50 threshold, wiping out hopes that an agreement by OPEC and non-OPEC countries to curb supplies had put a “floor” on prices above the US$40 range.

The drop in prices underscored the seemingly endless uncertainty that has hobbled the industry in recent years, causing companies to dramatically reorient their corporate structures.

“You have to put a business model in place that embraces the volatility,” said ConocoPhillips Co. CEO Ryan Lance.

“We know what to do when prices are higher—the real question is what do you do when prices are back in the US$40-or-so level.”

The lowering of break-even costs dominated discussion. In particular, executives focused on the economics of oily shale basins in the U.S., where production has boomed in recent years despite stubbornly low prices...

Full story

2) Russia’s Rosneft Says OPEC’s Oil Production Cuts May Not Be Extended

OIlPrice, 13 March 2017

Tsvetana Paraskova

Russia’s oil giant Rosneft sees a lack of will among the main signatories to the OPEC/non-OPEC deal and U.S. shale production as the main risks to a possible extension of the global supply cut deal, a Rosneft spokesman told Reuters on Monday.

“We think that in the long term global oil demand dynamics and reduced investment during the period of ultra low prices will balance the market, but that the risk of a price war resuming remains,” the spokesman said.

OPEC and 11 non-OPEC producers agreed in November to curtail their collective crude oil output by almost 1.8 million bpd between January and June, with OPEC shaving off around 1.2 million bpd, and non-OPEC producers – led by Russia – slashing another 558,000 bpd.

The deal had held prices above $50 per barrel before WTI fell to below $50 a barrel last week for the first time since December. This drop has further increased speculation whether the deal should or would be extended beyond its original expiry date at end-June, given the rise in U.S. shale.

Although OPEC is scheduled to decide on a possible extension in May, estimates and guesses are many, and now Rosneft has expressed its view via emailed answers to questions by Reuters.

Full post

3) Oil Bulls Exit Before Market Dive On Swollen U.S. Stockpiles

Bloomberg, 13 March 2017

Mark Shenk

Oil’s fall from grace last week started with hedge funds, and it may only get worse from here.

Investors cut bullish wagers on West Texas Intermediate crude to a one month-low, according to U.S. Commodity Futures Trading Commission data, a move that came just prior to a market dive that sent prices below $50 a barrel for the first time since December.

"This report is just the beginning," said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. "The volume and breadth of the decline this week show that there was massive liquidation. Next week’s report will be the blockbuster."

Optimism about an agreement between the Organization of Petroleum Exporting Countries and some non-OPEC producers to cut output is fizzling as stockpiles continue to climb and U.S. drilling rigs are returning at the fastest rate since 2012.

The slide in oil prices, which had traded between $50.50 and $55.24 since Dec. 16, helped drag the S&P 500 to its first weekly decline since January. WTI on Monday traded up 0.1 percent at $48.54 a barrel as of 10:46 a.m. in New York.

Full story

4) Hedge-Fund Trader Loses Big On Oil Bets That Ignored The Second Shale Revolution

The Wall Street Journal, 13 March 2017

Laurence Fletcher

Andurand’s Commodities Fund has lost about $130 million in first two months of 2017

Pierre Andurand, one of the world’s best-known oil traders, has suffered a large loss at the start of this year because of wrong-way bets on crude.

Mr. Andurand, who runs the $1.5 billion Andurand Commodities Fund, lost 8.5%, or approximately $130 million, in the first two months of this year, according to numbers sent to investors and reviewed by The Wall Street Journal. The loss makes his fund one of the global hedge-fund industry’s worst-performers in 2017.

A spokeswoman for Mr. Andurand declined to comment.

The France-born trader, who runs his fund out of offices opposite London luxury department store Harrods, gained 22% last year, helped by bullish bets, including buying one day after oil hit a 13-year low last January.

But like many funds, his has been too positive of late, recently forecasting oil would hit $70 a barrel early this year. On Monday, Brent, the global price benchmark, was trading at $51.26 per barrel, while U.S. crude was trading at $48.30 a barrel.

Hedge funds and other big money managers amassed a record number of bullish bets on Brent crude last month, according to the Intercontinental Exchange Inc. That came amid reports that the Organization of the Petroleum Exporting Countries has so far achieved around 90% of the production cuts agreed upon late last year.

But, having traded in a narrow range for most of this year, oil posted its biggest two-day selloff since June last week. Oil inventories in the U.S. have recently hit a record high in a sign that the massive glut that has depressed prices for more than two years is still plaguing the market. The U.S. Energy Department expects American oil production to rebound past 9.7 million barrels a day in 2018, breaking the record output level set in 1970.

Full story

5) Massive Oil Discovery In Alaska Is Biggest Onshore Find In 30 Years

CNN Money, 10 March 2017

Matt Egan

Some 1.2 billion barrels of oil have been discovered in Alaska, marking the biggest onshore discovery in the U.S. in three decades.

The massive find of conventional oil on state land could bring relief to budget pains in Alaska brought on by slumping production in the state and the crash in oil prices.

The new discovery was made in just the past few days in Alaska's North Slope, which was previously viewed as an aging oil basin.

Spanish oil giant Repsol (REPYY) and its privately-held U.S. partner Armstrong Energy announced the find on Thursday, predicting production could begin as soon as 2021 and lead to as much as 120,000 barrels of output per day.

The oil resources lie in a well, called Horseshoe, that's 75% owned by Denver-based Armstrong. Repsol owns the rest of this well.

The discovery is 20 miles south of where the two companies have already found oil in a project known as Pikka. That northern project is already in early development and is 51% owned by Armstrong, which is the operator on both developments.

"The interesting thing about this discovery is the North Slope was previously thought to be on its last legs. But this is a significant emerging find," Repsol spokesman Kristian Rix told CNNMoney.

Of course, this news won't ease rising concern among investors about the stubborn glut of oil in the U.S. There are increasing signs that shale oil producers are preparing to ramp up output after surviving a two-year price war with OPEC.

Full story

6) US Shale Revolution Yields New World Order

Natural Gas Now, 12 March 2017

Tom Shepstone

The US shale gas industry is, with new LNG export capacity, in position to dominate a new world order in energy with benefits for us and emerging nations.

There’s something new and beautiful happening as a result of the US shale gas industry. Our nation is now in position to dominate a new world order in energy with huge benefits to rural America and nations around the world who are emerging from poverty. It’s a story of exports, something we’ve not done so well at it in a very long time. It’s about shale gas produced in Pennsylvania, Ohio and Texas that is being converted to LNG and sold to Egypt, Mexico and Japan. It offers a demonstration of just how important energy infrastructure is to this country if we want to maximize the benefits of the shale revolution.

MARAN GAS ACHILLES (Courtesy: shipspottting.com © lappino)

The story, which is all about a LNG ship (see above) and an energy market that turned around, is told in the Gulf Times (courtesy of Bloomberg). Here are some key excerpts (emphasis added):

The US stands to become the world’s third-largest exporter by 2020, when it’s expected to ship about 8.3bn cubic feet a day of capacity, or 14% of the world’s share, according to London-based consultant Energy Aspects Ltd. That growth is a testament to the power of the shale boom of the last decade, helping to reduce the country’s reliance on foreign energy sources…

Cheniere, which built the Sabine Pass terminal in Louisiana, was the first to ship shale gas abroad. The Houston-based company is now in the process of starting up its third plant and, alone, is expected to own 7% of the world’s export capacity in 2020, according to Energy Aspects…

Prior to the start of US exports last year, Asia and Europe were seen as the likeliest customers. Gas production in Europe is declining as demand grows and, in some cases, countries have expressed a desire to displace pipeline imports from Russia, seeking to diversify their supply at a time of unsettled geopolitics…

However, while analysts and traders watched whether Europe would emerge as a big buyer, Mexico, which already imports the most US gas by pipeline, quickly became the largest importer of shipped-in LNG from the US, followed by Chile. China, South Korea and Japan boosted buying during the winter.

Perhaps the most unexpected customers were in the Middle East, as Jordan, Egypt and the UAE in tankers. Dominion Resources is expected to join the fray as a US exporter by the end of this year, with its Cove Point terminal in Maryland bringing the nation’s export capability to about 3.2bn cubic feet a day, according to Energy Aspects data.

For natural gas, it’s “a new world order” that not only promises to establish the US as the swing provider, but also allows emerging countries to take advantage of low prices, said Ted Michael, an LNG analyst with Genscape.

Egypt, Jordan and Pakistan are already taking advantage of the change by using tankers docked at their shores that are basically floating factories, able to convert chilled fuel shipped into the country back into gas so it could be distributed on their pipelines. Outfitting ships with regasification plants are a third of the cost of building an onshore facility, and can be installed in a quarter of the time.

“The revolution has many moving parts,” Michael said. The broadening of outlets for exported gas could “easily” help boost US gas output by about a third to 100bn cubic feet a day in the next five years, he said.

It’s quite a revolution, indeed, and the exciting part is that economies are being revived at both ends; in rural Pennsylvania and Ohio, for example where gas shipped through Cove Point will be produced, and in places such as Egypt and Pakistan struggling to come into the modern day world where it is consumed. None of this can happen without the pipelines and LNG ports fractivists have so vigorously opposed. They are, as we’ve noted here many times before, povertykeepers. While styling themselves as protectors, they are destroyers. But, the new world order with respect to energy is here. A world needing our inexpensive clean energy will not be denied. It’s too important.

7) Nick Butler: The Second Shale Revolution

Financial Times, 13 March 2017

The oil price is falling again, with the latest drop taking the price in the US below $50 a barrel. Behind the fall is a remarkable story of technical progress which is once again driving up the volume of oil produced from American shale rocks.

It is now almost a decade since the US shale revolution began. From almost nothing production of gas from shale rocks in the country has risen to almost 50bn cubic ft/day at the beginning of this year, according to data from the US Energy Administration. Low-cost convenient gas pushed coal out of the power sector. Instead of importing gas, as many had expected, the US became self-sufficient before becoming an exporter first of coal and then of gas, in both cases weakening already fragile global markets.

The shale revolution extended to oil, lifting US production by 3m barrels a day and forcing the Saudis to try to flood the market in an attempt to drive American producers out of business and maintain their own market share.

The fall in global prices did not have the intended effect. Some US production was cut back at the margin but the main impact of the Saudi policy has been to push the US shale industry into a process of dramatic cost cutting and technical advance. Now the full implications of that are beginning to be obvious: a second shale revolution is underway.

The story is impressive. Costs have been cut to the point where the industry as a whole breaks even at $50 — and in some cases even below that. But, most important, more reserves have been found — particularly of oil. That will be the focus of the second shale revolution and, once again, global markets will be severely disrupted.

After the dip last year, production of oil from shale rocks in the US is increasing again. Estimates for this year range from a net increase of between 400,000 and 800,000 b/d. And 2017 is not a one-off year. The Permian Basin in Texas — the main focus for the new activity — has oil reserves that exceed those of all the largest discovered fields globally, such as Ghawar in Saudi Arabia and Prudhoe Bay in Alaska

That means we can look forward to a strong continuing increase of perhaps as much as 800,000 b/d each year from shale until 2020. That would lift total US oil production by then from 9mb/d per day to around 11m.

Demand growth across the world is unlikely to exceed 1mb/d and could well be less. Extra US supplies will take the lions share of that growth and make it harder to reduce the overhang of stocks that puts a ceiling on prices. Even if Opec and Russia fully respect the quota system they have agreed, developments in America will outweigh their efforts. Opec and the Saudis in particular will have to make more cuts to maintain current prices. [..]

US shale has been the largest single factor affecting the global energy business in the last decade. Expectations have been overturned; prices set in a climate of ever-increasing scarcity and dependence on volatile insecure producing areas have been undermined. Those effects now look likely to continue and will be compounded by the shifts in technology I wrote about last week.

Those who assumed the shale revolution would be killed off by a cyclical downturn in prices have been proved wrong. Instead, we are seeing a structural shift with supply growth exceeding demand. The implications, especially for countries dependent on earning high prices for their exports, are very serious. The net effect is a redistribution of wealth away from producers in favour of consumers. We are in for a long period of instability, driven this time not by scarcity but by plenty.

Full post

8) German Minister Announces End Of Unilateral Climate Targets

Die Welt, 11 March 2017

Daniel Wetzel

Germany has always acted as pioneer and model pupil in climate policy. This role is now coming to an end. Minister of the Chancellery, Peter Altmaier, has denounced climate unilateralism.

Chancellor Angela Merkel and the Minister of the Chancellery Peter Altmaier; photo: Federal Government of Germany/Kugler

“I am not the most weighty, but the most heavy minister in the Cabinet,” the Minister of the Chancellery, Peter Altmaier, said last Friday at an event in the Hotel Adlon: “I have lost weight, but the gap with others was so great that my leadership was not at risk.”

As usual, Altmaier’s ironic treatment of his diet ensured cheerfulness among his listeners. Soon afterwards, however, the relaxed atmosphere in the Berlin Grand Hall turned into excitement.

For the federal Minister for Special Responsibilities promised the assembled business leaders and managers to fulfill a long-cherished wish: Germany’s expensive go-it-alone climatic policies could soon be over for good.

Thundering applause

“I am firmly convinced that the path of national climate targets is wrong,” Altmaier told the participants of the exclusive “Convention on Energy and Climate Policy” organised by the economic council of the ruling Christian Democratic Party (CDU). Although it is “difficult to cancel existing goals,” Altmaier said, in future “European and international targets” would be required.

Altmaier’s words sparked the first thunderous applause of the day — for a good reason: The Federal Government had always played the role of model pupil and “pioneer” in climate policy. For example, when the EU decided to reduce CO2 emissions by 20 percent by 2020, Germany decided to reduce its emissions by 40 percent. When Europe set itself a green energy target of 20 percent, Berlin had to surpass immediately with a national 35 percent target.

Expensive go-it-alone policies of this kind were not only received badly by German industry given that increasing energy prices and green regulations threaten its competitiveness. Environmental economists also criticised again and again that national unilateralism would not save any extra CO2 under the umbrella of the EU’s emissions trading scheme.

False ambition

Even before the UN Climate Conference in Paris at the end of 2015, Germany’s unilateral ambitions had led to controversial discussions. The federal government had argued that it wanted to encourage other nations to follow its lead by adopting equally ambitious CO2 targets. Critics argued that Germany undermined a coherent EU position at the UN Climate Summit, preventing the EU from speaking “with one voice.”

At the meeting of the CDU Economic Council in Berlin, Altmaier — just as EU Energy Commissioner Miguel Arias Canete had done before – aregued for a “level playing field” in Europe, i.e. cross-country rules for investments in energy efficiency and climate targets.

Bursting with anger, Alexander Cerbe, the chairman of Cologne’s utilities company Rheinenergie retorted: If the same investment conditions were so important for EU climate policy, why did Germany always go much further than the rest, Cerbe wanted to know. “You are quite right,” the federal minister replied to everyone’s surprise: He too considered unilateral goals as “the wrong approach.”

Altmaier’s position concurs with the new energy policy “Energy lab 2030″, developed by the CDU’s Economic Council over several months with the assistance of numerous expert committees and presented at their Congress on Friday. “Unilateral national targets for climate protection are counterproductive and should therefore be abandoned,” it says.

Objectives are over-ambitious

The fact that the federal government now seems intend to pursue only targets that are uniform throughout the EU may be due to the gradual realisation that Germany has adopted over-ambitious targets that cannot be achieved.

In its “Energy Concept 2010″, the federal government had decided to reduce carbon dioxide emissions by 40 percent by 2020, twice as much as the rest of Europe. The phasing out of non-CO2-emitting nuclear power plants did not seem to contradict these ambitions.

However, the climate target now proves to be over-ambitious. Among experts, it is certain that the federal government will clearly miss the promise of a 40% reduction in CO2 emissions by the end of the decade.

Translation GWPF

The London-based Global Warming Policy Forum is a world leading think tank on global warming policy issues. The GWPF newsletter is prepared by Director Dr Benny Peiser - for more information, please visit the website at www.thegwpf.com.

1 comment:

The climate scam is finally being exposed and ignored. Go Germany. Sanity at last.

Post a Comment