Shale Revolution Drives American Household’s Energy Cost To Record Low

In this newsletter:

1) Shale Boom 2.0: OPEC Underestimated U.S. Frackers

Bloomberg, 26 February 2017

2) Energy Superpower: Surging Exports Propel US To Bigger Impact On Global Oil Market

Financial Times, 28 February 2017

3) Shale Revolution Drives American Households' Energy Cost To Record Low

Energy Indepth, 9 February 2017

4) Editorial: The Carbon Tax Chimera

The Wall Street Journal, 25 February 2017

5) And Finally: Green Activists Abandon Their Cars,Their Rubbish And Their Pets

Power Line, 26 February 2017

Bloomberg, 26 February 2017

2) Energy Superpower: Surging Exports Propel US To Bigger Impact On Global Oil Market

Financial Times, 28 February 2017

3) Shale Revolution Drives American Households' Energy Cost To Record Low

Energy Indepth, 9 February 2017

4) Editorial: The Carbon Tax Chimera

The Wall Street Journal, 25 February 2017

5) And Finally: Green Activists Abandon Their Cars,Their Rubbish And Their Pets

Power Line, 26 February 2017

Full details:

1) Shale Boom 2.0: OPEC Underestimated U.S. Frackers

Bloomberg, 26 February 2017

Julian Lee

The second coming of shale could be even more powerful than the first. OPEC seems to be getting caught unawares.

The current boom in U.S. oil production is even stronger now than the run from July 2011 to April 2015. And this is with oil prices at half their previous level and before President Donald Trump has done anything to meet his pledge to “lift the restrictions on American energy and allow this wealth to pour into our communities.” Output growth could accelerate if prices rise, or costs fall further.

This is not how it was meant to be. OPEC launched a strategy to protect market share in 2014 with a specific aim to knock out high-cost oil production such as shale. After the group succumbed to internal financial pressures and agreed in November to cut output by around 1.2 million barrels a day, Saudi oil minister Khalid Al-Falih said he didn’t expect a big supply response from American shale producers in 2017.

Sources: Bloomberg; Department of Energy

It turns out the response was already well under way, and Al-Falih may not like the numbers. Data from the Department of Energy show U.S. oil production bottomed out in September. Since then oil companies have added an average of 125,000 barrels a day of production each month, taking output back above 9 million barrels a day for the first time since April.

What should really trouble OPEC, though, is that this rate of growth is even faster than the first shale boom. Over that earlier period, U.S. oil production rose at an average monthly rate of 93,000 barrels a day.

Market anticipation of the agreement between OPEC and its friends in November last year, and the actual deal, lifted WTI from a low reached in early 2016 of around $26. This time, shale producers aren’t waiting around — their output started picking up with WTI crude selling for around $45. During the last boom, WTI traded in a range at about double or triple that.

Okay, so part of the growth is coming from the Gulf of Mexico, where BP Plc’s Thunder Horse South and Royal Dutch Shell Plc’s Stones projects have both started producing in recent months. But that region also made a positive contribution to the earlier boom, as did Alaska. Most of the current growth is coming from the onshore, lower 48 states — home of the shale industry.

Increasing production from the U.S. is rapidly undermining the output cuts that OPEC is making and, unless those cuts get deeper in the coming months — which looks unlikely, given that compliance is already above 90 percent — things can only get worse for the producer group. Far from bringing the market back into balance, they run the risk that they have seriously underestimated the ability of U.S. domestic producers to adapt to lower prices. And what’s worse is that they may be able to raise production even faster if OPEC succeeds in pushing the price up.

Full story

2) Energy Superpower: Surging Exports Propel US To Bigger Impact On Global Oil Market

Financial Times, 28 February 2017

Gregory Meyer

Outbound shipments of more than 1.2m barrels a day present challenge to Opec nations

A voracious thirst for petroleum makes the US one of the largest importers of oil. But for the past two weeks it has also scaled the ranks of exporters.

Outbound shipments of crude have surpassed 1.2m barrels a day, more than last month’s daily production of Algeria, Ecuador or Qatar — each a member of OPEC.

The foreign sales underscore how the US has become more integrated into the world oil market since Washington lifted 40-year-old constraints on crude exports at the end of 2015. The US continues to import much more than it exports but its oil companies now have the freedom to market barrels abroad when it makes economic sense.

The situation presents a further challenge to Saudi Arabia and other Opec members, which historically held the power to turn supplies on and off when needed.

Or as Timothy Dove, chief executive of Pioneer Natural Resources, told analysts this month: “We’ll be significant swing producers in terms of worldwide supply.”

He noted the oil company soon planned to export to Asia two 525,000-barrel cargoes produced in the Permian basin of Texas.

US crude oil exports initially increased modestly after the export ban ended, partly reflecting the fact that sales had already been allowed to Canada. The shipments this year have blown past those levels and far exceed the baseline projections that the US Energy Information Administration made before Congress rescinded the restrictions.

In the year to date, US oil has been exported to destinations including eastern Canada, Spain, Singapore and China, according to ClipperData, a tanker tracking service. The shipments include not only high-quality shale types such as West Texas Intermediate crude but heavier grades pumped offshore such as Southern Green Canyon, according to ClipperData and industry executives.

Full story

3) Shale Revolution Drives American Households' Energy Cost To Record Low

Energy Indepth, 9 February 2017

Lily Emamian

Record-low natural gas prices enabled consumers to devote “less than 4% of their total annual household spending to energy in 2016, the smallest share ever recorded by the US government.”

The Business Council for Sustainable Energy, in partnership with Bloomberg New Energy, just released the 2017 Sustainable Energy in America Factbook. The report covers the across-the-board benefits for the rise in natural gas use across the United States, with the most notable benefit being the fact that American consumers are now spending less of their incomes on energy than ever before in the modern era.

The factbook found that record-low natural gas prices enabled consumers to devote “less than 4% of their total annual household spending to energy in 2016, the smallest share ever recorded by the US government,” as the following chart from the report shows,

The factbook reports that retail electricity prices fell 2.2 percent from 2015 to 2016 and consumers paid 3.9 percent lower prices than a decade ago. These lower prices have been particularly advantageous to energy intensive industries, as the report notes,

“Exceedingly low natural gas and electricity prices have helped to reduce costs for industrial players, particularly those in energy-intensive sectors. Despite a surge in the value of the dollar over 2015-16, the United States remains among the lowest cost markets for electricity in the world for industrial customers, beating out other large countries such as China, India, Mexico and Japan.”

The report also highlights the fact that low natural gas prices have allowed the U.S. economy to grow at the same time as we’ve reduced greenhouse gas emissions — a previously unheard of decoupling trend. One reason, the report notes, is because of increased natural gas use for electricity generation. In fact, natural gas is now the top fuel source for electrical generation, which has driven U.S. CO2 emissions to their lowest levels since 1991,

“Within the power sector, the progress is even more noteworthy: in 2016, greenhouse gas emissions from US power plants dropped 5.3% in just one year. Since 2005, the power sector has shrunk its carbon footprint by 24% – in other words, the US is 75% of the way to the Clean Power Plan’s “32% by 2030” headline target, with 14 additional years left to go. In large part, this decarbonization is due to market forces: the boom in domestic natural gas production has provided the sector with a cheap, cleaner burning source of fuel (a natural gas combined-cycle plant emits roughly 60% less carbon than a coal-fired unit); additionally, renewable energy costs have fallen dramatically and corporations have captured cost-savings through energy efficiency measures.”

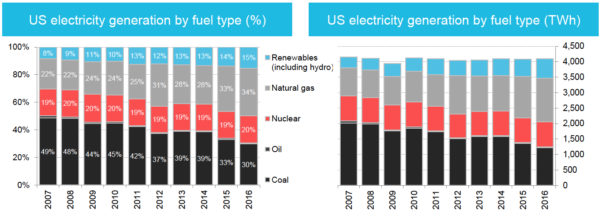

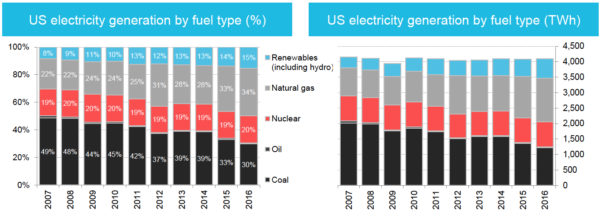

As the following chart from the factbook shows, natural as accounted for 34 percent of U.S. electrical generation in 2016 — up from 22 percent in 2007.

Theses trends, of course, are thanks to increased natural gas production and the development of better infrastructure throughout the country. The combination has given states and consumers better access to power from a variety of sources, from natural gas to electricity.

Full post

4) Editorial: The Carbon Tax Chimera

The Wall Street Journal, 25 February 2017

The Shultz-Baker proposal sounds better than it would work.

The climate may change but one thing that never does is the use of climate change as a political wedge against Republicans. Also never changing is the call from some Republicans to neutralize the issue by handing more economic power to the federal government through a tax on carbon. The risk is that Donald Trump takes up the idea, which would hurt the economy with little benefit to the environment.

George Shultz and James Baker, the esteemed former secretaries of State, have joined a group of GOP worthies for a carbon tax and recently pressed the case in these pages. They propose a gradually increasing tax that would be redistributed to Americans as a “dividend.” This tax on fossil fuels would replace the Obama Administration’s Clean Power Plan and a crush of other punitive regulations. Energy imports from countries without a similar structure would face a tax at the border.

A carbon tax would be better than bankrupting industries by regulation and more efficient than a “cap-and-trade” emissions credit scheme. Such a tax might be worth considering if traded for radically lower taxes on capital or income, or is narrowly targeted like a gasoline tax. But in the real world the Shultz-Baker tax is likely to be one more levy on the private economy. Even if a grand tax swap were politically possible, a future Congress might jack up rates or find ways to reinstate regulations.

Another problem is the “dividend.” A carbon tax would be regressive, as the poor spend more of their income on gasoline and household energy. The plan purports to solve this in part by promising to return the tax to the American public. But the purpose of taxes is to fund government services, not shuffle money from one payer to another. No doubt politicians would take a cut to funnel into renewable energy or some other vote-buying program.

The rebates would also become a new de facto entitlement with an uncertain funding future. A family of four would receive a $2,000 payout in the first year from a carbon tax, according to a report from the Climate Leadership Council, and that “amount would grow over time as the carbon tax rate increases.” But the point of taxing carbon is to emit less of it, and eventually revenues would decline as the tax rate rises. The public would then receive minimal or no help paying for energy the government made more expensive, and the progressives will try to make up the difference by raising other taxes.

Meanwhile, the energy import fee looks like an appeal to Mr. Trump’s protectionist impulses, but it’s too clever by half. The idea is an attempt to export U.S. climate and tax policy with the threat of tariffs, which other countries my resent. It’s a particular stick in the eye to Canada and Mexico and the promise of North American energy security. China and India aren’t likely to follow while they need fossil fuels to lift millions out of poverty.

The anticarbon Republicans want a commission to consider after five years whether to raise the tax based on the “best climate science available,” but all methods of calculating a price for carbon are susceptible to political manipulation. The Obama Administration spent years fudging “social cost of carbon” estimates to justify its regulatory agenda. The tax rate would also be influenced by international climate models that have overestimated the increase in global temperature for nearly two decades.

Full post

5) And Finally: Green Activists Abandon Their Cars, Their Rubbish And Their Pets

Power Line, 26 February 2017

Steven Hayward

We’re reported before on the environmental mess left behind by the Dakota Access Pipeline protest neat the Standing Rock Indian reservation (here and here), but there’s still one more installment to the story that deserves to be entered in the ledger:

Piles of debris remain at Oceti Sakowin, the main Dakota Access Pipeline protest camp. Some of these items were donated by people who support the movement. Others were abandoned by protesters who left camp.

Rescue group catching animals left behind at DAPL protest camps

NEAR CANNON BALL, N.D. (KFYR) – Crews continue to clean up the Oceti Sakowin protest camp. As officers moved in and protesters moved out, garbage wasn’t the only thing left behind

Two dogs and six puppies were found and rescued at the main Dakota Access Pipeline Camp by Furry Friends Rockin’ Rescue.

The rescue group has been working hard to catch all the animals that were left behind at the camp. . .

“It’s a mess down there, so it’s really, really hard to find these animals and get them,” Julie Schirado with the rescue group said. “We have a couple cases of mange,” Hardy said. “I know we’ve had some problems with claws that haven’t been clipped before.” Some of the animals have frost bitten ears and patchy fur.

So let’s add it all up: protesters claiming to be concerned about nature and wildlife leave huge amounts of trash and abandoned vehicles that threaten the waterway they say is “sacred,” and abandon their own pets.

Full post

Bloomberg, 26 February 2017

Julian Lee

The second coming of shale could be even more powerful than the first. OPEC seems to be getting caught unawares.

The current boom in U.S. oil production is even stronger now than the run from July 2011 to April 2015. And this is with oil prices at half their previous level and before President Donald Trump has done anything to meet his pledge to “lift the restrictions on American energy and allow this wealth to pour into our communities.” Output growth could accelerate if prices rise, or costs fall further.

This is not how it was meant to be. OPEC launched a strategy to protect market share in 2014 with a specific aim to knock out high-cost oil production such as shale. After the group succumbed to internal financial pressures and agreed in November to cut output by around 1.2 million barrels a day, Saudi oil minister Khalid Al-Falih said he didn’t expect a big supply response from American shale producers in 2017.

Sources: Bloomberg; Department of Energy

It turns out the response was already well under way, and Al-Falih may not like the numbers. Data from the Department of Energy show U.S. oil production bottomed out in September. Since then oil companies have added an average of 125,000 barrels a day of production each month, taking output back above 9 million barrels a day for the first time since April.

What should really trouble OPEC, though, is that this rate of growth is even faster than the first shale boom. Over that earlier period, U.S. oil production rose at an average monthly rate of 93,000 barrels a day.

Market anticipation of the agreement between OPEC and its friends in November last year, and the actual deal, lifted WTI from a low reached in early 2016 of around $26. This time, shale producers aren’t waiting around — their output started picking up with WTI crude selling for around $45. During the last boom, WTI traded in a range at about double or triple that.

Okay, so part of the growth is coming from the Gulf of Mexico, where BP Plc’s Thunder Horse South and Royal Dutch Shell Plc’s Stones projects have both started producing in recent months. But that region also made a positive contribution to the earlier boom, as did Alaska. Most of the current growth is coming from the onshore, lower 48 states — home of the shale industry.

Increasing production from the U.S. is rapidly undermining the output cuts that OPEC is making and, unless those cuts get deeper in the coming months — which looks unlikely, given that compliance is already above 90 percent — things can only get worse for the producer group. Far from bringing the market back into balance, they run the risk that they have seriously underestimated the ability of U.S. domestic producers to adapt to lower prices. And what’s worse is that they may be able to raise production even faster if OPEC succeeds in pushing the price up.

Full story

2) Energy Superpower: Surging Exports Propel US To Bigger Impact On Global Oil Market

Financial Times, 28 February 2017

Gregory Meyer

Outbound shipments of more than 1.2m barrels a day present challenge to Opec nations

A voracious thirst for petroleum makes the US one of the largest importers of oil. But for the past two weeks it has also scaled the ranks of exporters.

Outbound shipments of crude have surpassed 1.2m barrels a day, more than last month’s daily production of Algeria, Ecuador or Qatar — each a member of OPEC.

The foreign sales underscore how the US has become more integrated into the world oil market since Washington lifted 40-year-old constraints on crude exports at the end of 2015. The US continues to import much more than it exports but its oil companies now have the freedom to market barrels abroad when it makes economic sense.

The situation presents a further challenge to Saudi Arabia and other Opec members, which historically held the power to turn supplies on and off when needed.

Or as Timothy Dove, chief executive of Pioneer Natural Resources, told analysts this month: “We’ll be significant swing producers in terms of worldwide supply.”

He noted the oil company soon planned to export to Asia two 525,000-barrel cargoes produced in the Permian basin of Texas.

US crude oil exports initially increased modestly after the export ban ended, partly reflecting the fact that sales had already been allowed to Canada. The shipments this year have blown past those levels and far exceed the baseline projections that the US Energy Information Administration made before Congress rescinded the restrictions.

In the year to date, US oil has been exported to destinations including eastern Canada, Spain, Singapore and China, according to ClipperData, a tanker tracking service. The shipments include not only high-quality shale types such as West Texas Intermediate crude but heavier grades pumped offshore such as Southern Green Canyon, according to ClipperData and industry executives.

Full story

3) Shale Revolution Drives American Households' Energy Cost To Record Low

Energy Indepth, 9 February 2017

Lily Emamian

Record-low natural gas prices enabled consumers to devote “less than 4% of their total annual household spending to energy in 2016, the smallest share ever recorded by the US government.”

The Business Council for Sustainable Energy, in partnership with Bloomberg New Energy, just released the 2017 Sustainable Energy in America Factbook. The report covers the across-the-board benefits for the rise in natural gas use across the United States, with the most notable benefit being the fact that American consumers are now spending less of their incomes on energy than ever before in the modern era.

The factbook found that record-low natural gas prices enabled consumers to devote “less than 4% of their total annual household spending to energy in 2016, the smallest share ever recorded by the US government,” as the following chart from the report shows,

The factbook reports that retail electricity prices fell 2.2 percent from 2015 to 2016 and consumers paid 3.9 percent lower prices than a decade ago. These lower prices have been particularly advantageous to energy intensive industries, as the report notes,

“Exceedingly low natural gas and electricity prices have helped to reduce costs for industrial players, particularly those in energy-intensive sectors. Despite a surge in the value of the dollar over 2015-16, the United States remains among the lowest cost markets for electricity in the world for industrial customers, beating out other large countries such as China, India, Mexico and Japan.”

The report also highlights the fact that low natural gas prices have allowed the U.S. economy to grow at the same time as we’ve reduced greenhouse gas emissions — a previously unheard of decoupling trend. One reason, the report notes, is because of increased natural gas use for electricity generation. In fact, natural gas is now the top fuel source for electrical generation, which has driven U.S. CO2 emissions to their lowest levels since 1991,

“Within the power sector, the progress is even more noteworthy: in 2016, greenhouse gas emissions from US power plants dropped 5.3% in just one year. Since 2005, the power sector has shrunk its carbon footprint by 24% – in other words, the US is 75% of the way to the Clean Power Plan’s “32% by 2030” headline target, with 14 additional years left to go. In large part, this decarbonization is due to market forces: the boom in domestic natural gas production has provided the sector with a cheap, cleaner burning source of fuel (a natural gas combined-cycle plant emits roughly 60% less carbon than a coal-fired unit); additionally, renewable energy costs have fallen dramatically and corporations have captured cost-savings through energy efficiency measures.”

As the following chart from the factbook shows, natural as accounted for 34 percent of U.S. electrical generation in 2016 — up from 22 percent in 2007.

Theses trends, of course, are thanks to increased natural gas production and the development of better infrastructure throughout the country. The combination has given states and consumers better access to power from a variety of sources, from natural gas to electricity.

Full post

4) Editorial: The Carbon Tax Chimera

The Wall Street Journal, 25 February 2017

The Shultz-Baker proposal sounds better than it would work.

The climate may change but one thing that never does is the use of climate change as a political wedge against Republicans. Also never changing is the call from some Republicans to neutralize the issue by handing more economic power to the federal government through a tax on carbon. The risk is that Donald Trump takes up the idea, which would hurt the economy with little benefit to the environment.

George Shultz and James Baker, the esteemed former secretaries of State, have joined a group of GOP worthies for a carbon tax and recently pressed the case in these pages. They propose a gradually increasing tax that would be redistributed to Americans as a “dividend.” This tax on fossil fuels would replace the Obama Administration’s Clean Power Plan and a crush of other punitive regulations. Energy imports from countries without a similar structure would face a tax at the border.

A carbon tax would be better than bankrupting industries by regulation and more efficient than a “cap-and-trade” emissions credit scheme. Such a tax might be worth considering if traded for radically lower taxes on capital or income, or is narrowly targeted like a gasoline tax. But in the real world the Shultz-Baker tax is likely to be one more levy on the private economy. Even if a grand tax swap were politically possible, a future Congress might jack up rates or find ways to reinstate regulations.

Another problem is the “dividend.” A carbon tax would be regressive, as the poor spend more of their income on gasoline and household energy. The plan purports to solve this in part by promising to return the tax to the American public. But the purpose of taxes is to fund government services, not shuffle money from one payer to another. No doubt politicians would take a cut to funnel into renewable energy or some other vote-buying program.

The rebates would also become a new de facto entitlement with an uncertain funding future. A family of four would receive a $2,000 payout in the first year from a carbon tax, according to a report from the Climate Leadership Council, and that “amount would grow over time as the carbon tax rate increases.” But the point of taxing carbon is to emit less of it, and eventually revenues would decline as the tax rate rises. The public would then receive minimal or no help paying for energy the government made more expensive, and the progressives will try to make up the difference by raising other taxes.

Meanwhile, the energy import fee looks like an appeal to Mr. Trump’s protectionist impulses, but it’s too clever by half. The idea is an attempt to export U.S. climate and tax policy with the threat of tariffs, which other countries my resent. It’s a particular stick in the eye to Canada and Mexico and the promise of North American energy security. China and India aren’t likely to follow while they need fossil fuels to lift millions out of poverty.

The anticarbon Republicans want a commission to consider after five years whether to raise the tax based on the “best climate science available,” but all methods of calculating a price for carbon are susceptible to political manipulation. The Obama Administration spent years fudging “social cost of carbon” estimates to justify its regulatory agenda. The tax rate would also be influenced by international climate models that have overestimated the increase in global temperature for nearly two decades.

Full post

5) And Finally: Green Activists Abandon Their Cars, Their Rubbish And Their Pets

Power Line, 26 February 2017

Steven Hayward

We’re reported before on the environmental mess left behind by the Dakota Access Pipeline protest neat the Standing Rock Indian reservation (here and here), but there’s still one more installment to the story that deserves to be entered in the ledger:

Piles of debris remain at Oceti Sakowin, the main Dakota Access Pipeline protest camp. Some of these items were donated by people who support the movement. Others were abandoned by protesters who left camp.

Rescue group catching animals left behind at DAPL protest camps

NEAR CANNON BALL, N.D. (KFYR) – Crews continue to clean up the Oceti Sakowin protest camp. As officers moved in and protesters moved out, garbage wasn’t the only thing left behind

Two dogs and six puppies were found and rescued at the main Dakota Access Pipeline Camp by Furry Friends Rockin’ Rescue.

The rescue group has been working hard to catch all the animals that were left behind at the camp. . .

“It’s a mess down there, so it’s really, really hard to find these animals and get them,” Julie Schirado with the rescue group said. “We have a couple cases of mange,” Hardy said. “I know we’ve had some problems with claws that haven’t been clipped before.” Some of the animals have frost bitten ears and patchy fur.

So let’s add it all up: protesters claiming to be concerned about nature and wildlife leave huge amounts of trash and abandoned vehicles that threaten the waterway they say is “sacred,” and abandon their own pets.

Full post

The London-based Global Warming Policy Forum is a world leading think tank on global warming policy issues. The GWPF newsletter is prepared by Director Dr Benny Peiser - for more information, please visit the website at www.thegwpf.com.

1 comment:

The photo says it all. Leftist snowflakes ignorant and genuinely uncaring about the environment, their own pets for Godsake kidding themselves about how aware and in touch they are....while it suits them. Hypocrisy is such a mild word. It should be the equal of rape, incest, murder and tickling children to death. There is no hope for america until their children get educated by people who are educated.

Post a Comment

Thank you for joining the discussion. Breaking Views welcomes respectful contributions that enrich the debate. Please ensure your comments are not defamatory, derogatory or disruptive. We appreciate your cooperation.