One of Donald Trump’s main election promises was to slash taxes, including the corporate tax rate.

His election manifesto – under the bold heading “Tax reform will make America great again” – declared that he would reduce the corporate rate from 35 per cent to 15 per cent because companies were deserting America because of its high taxes.

His election manifesto – under the bold heading “Tax reform will make America great again” – declared that he would reduce the corporate rate from 35 per cent to 15 per cent because companies were deserting America because of its high taxes.

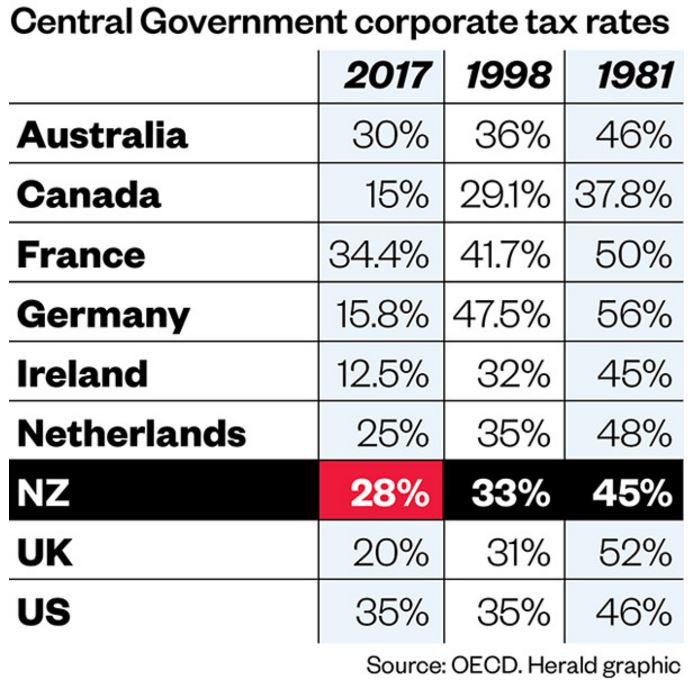

An official pre-election strategy statement contained these comments: “Politicians in Washington have let America fall from the best corporate tax rates in the industrialised world in the 1980s (thanks to Ronald Reagan) to the worst rate in the industrial world. This is unacceptable. Under the Trump plan, America will compete with the world and win by cutting the corporate tax rate to 15 per cent, taking our rate from one of the worst to one of the best.”

The potential tax cut has major implications for governments around the world, including New Zealand.

In the 19th century US Government revenue mainly came from indirect taxes, particularly on alcohol, tobacco, carriages, sugar, property sales, corporate bonds and slaves.

At the end of the century a corporate tax was introduced but was later declared unconstitutional by the US Supreme Court.

However, an amendment to the constitution in 1913, called the 16th amendment, allowed the federal Government to collect direct taxes and a 1 per cent corporate tax was imposed.

The rate reached an all-time high of 52.8 per cent in the late 1960s but had fallen to 46 per cent when Reagan became President in January 1981.

Reagan is one of Trump’s heroes because he cut corporate tax from 46 per cent to 40 in 1987 and from 40 per cent to 34 per cent the following year.

The rate was increased to 35 per cent in 1993 and has remained at that level, the highest in the OECD.

But headline corporate tax rates are complex for a number of reasons, including a plethora of tax deductions and because eight of the 31 OECD countries, including Canada, Germany and the United States (see accompanying table) have additional state taxes.

As a consequence, Canada’s total corporate tax rate goes from 15 per cent to 26.8 per cent after including state taxes, Germany’s to 30.2 per cent and the United States’ to 39 per cent.

However, US companies are not overly disadvantaged as the federal Government’s headline 35 per cent figure does not tell the full story.

The effective US corporate tax rate is below 30 per cent and the ratio of corporate tax to the Government’s total revenue has fallen from 16.4 per cent to 8.4 per cent since 1965, while the equivalent ratio for personal income tax has increased from 31.7 per cent to 39.3 per cent over the same period.

A 2014 study by the US Congressional Research Service concluded that the overall US company tax rate of 39 per cent compared with an unweighted 25.5 per cent for the remaining 30 OECD countries but the effective company tax rate, which takes into account tax deductions, is only 27.1 per cent for the US compared with 23.3 per cent for the other 30 OECD countries.

The effective tax rate in the US is substantially lower than the statutory rate because of a large number of deductions. The largest is that American companies do not have to pay US tax on foreign profits that remain offshore.

New Zealand’s tax development has followed a similar route to the US with indirect taxes, particularly on alcohol, tobacco and sugar, forming the bulk of government revenue in the 19th century. Direct taxes became more important in the 20th century.

Our company tax rate was 45 per cent in the early 1980s, rising to 48 per cent in the late 1980s. The rate was cut to 33 per cent in the early 1990s, 30 per cent in the mid-2000s and 28 per cent in recent years.

New Zealand’s total tax revenue as a percentage of GDP has increased from 23.2 per cent to 32.5 per cent since 1965, while the OECD average has risen from 24.5 per cent to 34.2 per cent over the same period.

New Zealand’s total tax to GDP ratio is slightly below the OECD average but the United States is well below, 25.9 per cent to 34.2 per cent.

According to standardised OECD statistics, the main sources of tax revenue are as follows:

- New Zealand: 38.6 per cent from personal income taxes, 38.4 per cent from indirect taxes (mainly GST) and 13.2 per cent from corporate taxes

- United States: 39.3 per cent on personal income taxes, 24.0 per cent social security contributions, 17.4 per cent from indirect taxes and 8.4 per cent from corporate taxes.

Two major differences between New Zealand and the US is that the latter has social security contributions, from employees and employers, that fund old-age pensions and disability insurance whereas New Zealand funds these through general taxation and ACC.

In addition, the US has widespread capital gains taxes while this is a minimal figure in New Zealand.

Corporate tax rate changes have major implications, as demonstrated by the introduction of a 12.5 per cent rate in Ireland in the early 1990s.

This tax rate, a number of Irish tax rulings and US tax rules that exempt American companies from US tax on non-repatriated profits have allowed Apple and other major global companies to pay minimal tax, including in New Zealand.

The Irish Government applied the 12.5 per cent tax rate only on profits generated in Ireland and a number of these global companies have also set up Irish “head offices” whereby non-Irish global profits are not subject to tax.

Under this structure, Apple has channelled a substantial proportion of its global sales, including profits on Apple products shipped from China to New Zealand, through its Irish “head office”.

Apple has probably paid minimal tax in Ireland, the US, New Zealand or China on these China-to-New Zealand shipments.

A reduction in the US corporate tax rate from 35 per cent to 15 per cent could have a huge impact on these global tax arrangements and encourage Apple, and other global giants, to pay tax, including tax in New Zealand.

However, the bigger issue is that reductions in corporate tax rates encourages capital to move from high- to low-tax countries and a US corporate tax cut should attract capital to the US.

This would boost the country’s capital expenditure and labour demand.

Other countries, including New Zealand, will be under pressure to reduce their corporate tax rates to curtail any capital outflows to the US.

Wall St analysts are drooling over the prospect of a US corporate tax cut although they recognise that the devil will be in the details.

Trump may cut the headline rate from 35 per cent to 15 per cent but there will be reductions in tax deductibles to partly offset this.

One of the issues under scrutiny is the tax deductibility of interest.

There is widespread speculation that this will be abolished, partly because it creates huge distortions as dividends are not tax-deductible.

The removal of interest tax-deductibility would partly compensate for the 35 per cent to 15 per cent tax cut and would remove the incentive for companies to borrow to buy back their shares.

The removal of interest deductibility would be a significant development, with global ramifications, as it was first introduced in the US in 1918.

The US, and the rest of the world, patiently awaits President Trump’s tax proposals with a clear understanding that the specific details will be more important than the 15 per cent headline figure.

Brian Gaynor is an investment analyst and the Executive Director of Milford Asset Management.

Brian Gaynor is an investment analyst and the Executive Director of Milford Asset Management.

No comments:

Post a Comment

Thank you for joining the discussion. Breaking Views welcomes respectful contributions that enrich the debate. Please ensure your comments are not defamatory, derogatory or disruptive. We appreciate your cooperation.