In this newsletter:

1) New climate study: Ice ages much more frequent than thought

SciTech Daily, 12 January 2023

2) Global temperature 2022 – same again

Net Zero Watch, 13 January 2023

3) Europe's coal exit postponed in face of energy crisis

Anadolu News Agency, 12 January 2023

4) Half of green claims used to sell products in EU are misleading, Brussels finds

Financial Times, 12 January 2023

5) Electric car makers put the brakes on UK production because many drivers think the vehicles are too expensive

Daily Mail, 11 January 2023

6) Green Britain: People running out of energy credit every 10 seconds

BBC News, 12 January 2023

SciTech Daily, 12 January 2023

2) Global temperature 2022 – same again

Net Zero Watch, 13 January 2023

3) Europe's coal exit postponed in face of energy crisis

Anadolu News Agency, 12 January 2023

4) Half of green claims used to sell products in EU are misleading, Brussels finds

Financial Times, 12 January 2023

5) Electric car makers put the brakes on UK production because many drivers think the vehicles are too expensive

Daily Mail, 11 January 2023

6) Green Britain: People running out of energy credit every 10 seconds

BBC News, 12 January 2023

7) Ben Marlow: Britain's electric car dream is all but over

The Daily Telegraph, 12 January 2023

The Daily Telegraph, 12 January 2023

8) Windfarms receive £227million subsidies to switch off

The Herald, 11 January 2023

The Herald, 11 January 2023

9) Ralph Schoellhammer: The German Greens are playing into Russia’s hands

Unherd, 12 January 2023

Unherd, 12 January 2023

10) Marian L. Tupy: Why is Paul Ehrlich so hard to ignore?

The Wall Street Journal, 13 January 2023

The Wall Street Journal, 13 January 2023

Full details:

1) New climate study: Ice ages much more frequent than thought

SciTech Daily, 12 January 2023

An unexpected discovery of a previously unstudied sediment core from Antarctica by researchers from the University of Otago has flipped our understanding of how often ice ages occurred in Antarctica.

According to Dr. Christian Ohneiser, the lead author of the study and a member of the Department of Geology, it appears that ice ages occurred much more frequently than previously believed.

“Until this research, it was common knowledge that over the last million years global ice volume, which includes Antarctica’s ice sheets, expanded and retreated every 100,000 years. However, this research shows they actually advanced and retreated much more often – every 41,000 years – until at least 400,000 years ago,” he says.

SciTech Daily, 12 January 2023

An unexpected discovery of a previously unstudied sediment core from Antarctica by researchers from the University of Otago has flipped our understanding of how often ice ages occurred in Antarctica.

According to Dr. Christian Ohneiser, the lead author of the study and a member of the Department of Geology, it appears that ice ages occurred much more frequently than previously believed.

“Until this research, it was common knowledge that over the last million years global ice volume, which includes Antarctica’s ice sheets, expanded and retreated every 100,000 years. However, this research shows they actually advanced and retreated much more often – every 41,000 years – until at least 400,000 years ago,” he says.

The IPCC consensus on the frequency of ice ages; Climate Change 2001, Fig. 2.22

The study, published in the journal Nature Geosciences, came about after Dr. Ohneiser sampled a sediment core from the Ross Sea for a different project which was designed to reconstruct the retreat of the Ross Ice Shelf after the last ice age.

“The 6.2-meter core was recovered in 2003 and placed in an archive in the US but was not studied further. I sampled it because I was expecting the core to have a record spanning the last 10,000 or so years. I conducted a paleomagnetic analysis on the core, which reconstructs changes in the earth’s magnetic field, and found a magnetic reversal showing it was much older and had a record spanning more than 1 million years.”

Sedimentary and magnetic mineral indicators enabled Dr. Ohneiser to reconstruct how big the Ross Ice Shelf, and the West Antarctic Ice Sheet which feeds the shelf, were.

“Icebergs, which come from the ice shelf, have sediment and rocks attached to their underside. When icebergs break off they float out to sea and drop the rocks and sediment as it melts, these rocks and sediments can also come directly from the ice shelf if the ice was over the core site. By figuring out how much of this debris is in the core through time we can build a picture of the changes in the size of the ice sheet,” he says.

Previous understanding of ice age frequencies was based on assumptions and incomplete data sets, but knowledge of them is important as the world faces climate change.

“Antarctica’s ice sheets have the capacity to increase sea-level significantly over the coming centuries. Paleoclimate reconstructions can give us clues on how the ice sheets might behave as atmospheric CO2 levels increase.

Because the response of ice sheets to any change in climate occurs very slowly, reconstructions on past ice sheet behavior provide constraints on how big or small the ice sheets were and how quickly they have retreated and regrown under different climate conditions. These reconstructions provide baseline information on the natural behavior of ice sheets in the past before humans started messing with the atmosphere.”

Dr. Ohneiser believes the study highlights how New Zealand is punching above its weight in terms of Antarctic research.

“New Zealand is a global leader in the field – the Antarctic Science Platform project team will soon drill for a sedimentary record near the west Antarctic ice sheet grounding line. This New Zealand-led expedition will be the world’s most southern sediment drilling expedition ever.”

Reference: “West Antarctic ice volume variability paced by obliquity until 400,000 years ago” by Christian Ohneiser, Christina L. Hulbe, Catherine Beltran, Christina R. Riesselman, Christopher M. Moy, Donna B. Condon and Rachel A. Worthington, 5 December 2022, Nature Geoscience. DOI: 10.1038/s41561-022-01088-w

2) Global temperature 2022 – same again

Net Zero Watch, 13 January 2023

Dr David Whitehouse, Science editor

NASA, NOAA and the UK Met Office have released the global temperature for 2022, showing it to be a warm year, ranked sixth warmest year on record. It was subdued, the researchers say, because we have had the third consecutive year of La Nina conditions.

The announcement was accompanied with the usual proviso that the past nine years were the warmest recorded. But anyone thinking about the claims and numbers should also look behind the headlines.

Fig 1 shows the global temperature anomaly this century: blue is HadCRUT5, Orange is NASA and grey is NOAA.

The study, published in the journal Nature Geosciences, came about after Dr. Ohneiser sampled a sediment core from the Ross Sea for a different project which was designed to reconstruct the retreat of the Ross Ice Shelf after the last ice age.

“The 6.2-meter core was recovered in 2003 and placed in an archive in the US but was not studied further. I sampled it because I was expecting the core to have a record spanning the last 10,000 or so years. I conducted a paleomagnetic analysis on the core, which reconstructs changes in the earth’s magnetic field, and found a magnetic reversal showing it was much older and had a record spanning more than 1 million years.”

Sedimentary and magnetic mineral indicators enabled Dr. Ohneiser to reconstruct how big the Ross Ice Shelf, and the West Antarctic Ice Sheet which feeds the shelf, were.

“Icebergs, which come from the ice shelf, have sediment and rocks attached to their underside. When icebergs break off they float out to sea and drop the rocks and sediment as it melts, these rocks and sediments can also come directly from the ice shelf if the ice was over the core site. By figuring out how much of this debris is in the core through time we can build a picture of the changes in the size of the ice sheet,” he says.

Previous understanding of ice age frequencies was based on assumptions and incomplete data sets, but knowledge of them is important as the world faces climate change.

“Antarctica’s ice sheets have the capacity to increase sea-level significantly over the coming centuries. Paleoclimate reconstructions can give us clues on how the ice sheets might behave as atmospheric CO2 levels increase.

Because the response of ice sheets to any change in climate occurs very slowly, reconstructions on past ice sheet behavior provide constraints on how big or small the ice sheets were and how quickly they have retreated and regrown under different climate conditions. These reconstructions provide baseline information on the natural behavior of ice sheets in the past before humans started messing with the atmosphere.”

Dr. Ohneiser believes the study highlights how New Zealand is punching above its weight in terms of Antarctic research.

“New Zealand is a global leader in the field – the Antarctic Science Platform project team will soon drill for a sedimentary record near the west Antarctic ice sheet grounding line. This New Zealand-led expedition will be the world’s most southern sediment drilling expedition ever.”

Reference: “West Antarctic ice volume variability paced by obliquity until 400,000 years ago” by Christian Ohneiser, Christina L. Hulbe, Catherine Beltran, Christina R. Riesselman, Christopher M. Moy, Donna B. Condon and Rachel A. Worthington, 5 December 2022, Nature Geoscience. DOI: 10.1038/s41561-022-01088-w

2) Global temperature 2022 – same again

Net Zero Watch, 13 January 2023

Dr David Whitehouse, Science editor

NASA, NOAA and the UK Met Office have released the global temperature for 2022, showing it to be a warm year, ranked sixth warmest year on record. It was subdued, the researchers say, because we have had the third consecutive year of La Nina conditions.

The announcement was accompanied with the usual proviso that the past nine years were the warmest recorded. But anyone thinking about the claims and numbers should also look behind the headlines.

Fig 1 shows the global temperature anomaly this century: blue is HadCRUT5, Orange is NASA and grey is NOAA.

What is quite apparent is that the global temperature record in the 21st century spends long periods relatively flat. The so-called hiatus, for instance, lasted from circa 2001 and 2013 and was ended by a very strong El Nino. Since then there has been another period of relatively unchanging temperature. Noticeable increases in temperature occur in the lead-in to an El Nino, such as the increase of approx. 0.3°C between 2011-2015.

The stepwise influence of El Nino events on the long-term trends seems very apparent. It was the strong El Nino of 1998 that marked the a jump of global temperature to the hiatus, and the 2015 El Nino may have done the same. Of course no one knows how long the current stagnation will continue. Everyone is expecting the three-year La Nina to lift. Some estimate that these events have depressed the global temperature by about 0.06°C. If there is another El Nino in 2024 then a new global record will almost certainly result.

Looking at the distribution of recent warming the dominance of the arctic is obvious. It almost leads one to suggest that the phrase global warming should be replaced by arctic warming!

Feedback: david.whitehouse@netzerowatch.com

3) Europe's coal exit postponed in face of energy crisis

Anadolu News Agency, 12 January 2023

3) Europe's coal exit postponed in face of energy crisis

Anadolu News Agency, 12 January 2023

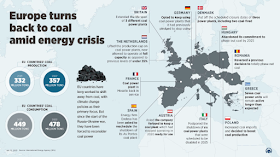

EU governments reschedule shutdown of coal-fired power plants, shelving climate goals due to energy supply constraints from Russia-Ukraine war

EU countries have long worked to shift away from coal, with climate change policies as their primary focus, but since the start of the Russia-Ukraine war, they have been forced to reconsider coal power due to the disruption of the affordable natural gas supply from Russia.

The energy crisis also led to a downshift in environmentalist pressure against coal use in European countries.

Global coal consumption climbed 1.2% in 2022 compared to the previous year, while the growth in the EU reached 6.5%, according to the International Energy Agency's (IEA) annual Coal 2022 study.

The amount of coal consumed by the bloc rose from 449 million tons in 2021 to 478 million tons in 2022 due to rising demand for coal in electricity production.

EU countries have long worked to shift away from coal, with climate change policies as their primary focus, but since the start of the Russia-Ukraine war, they have been forced to reconsider coal power due to the disruption of the affordable natural gas supply from Russia.

The energy crisis also led to a downshift in environmentalist pressure against coal use in European countries.

Global coal consumption climbed 1.2% in 2022 compared to the previous year, while the growth in the EU reached 6.5%, according to the International Energy Agency's (IEA) annual Coal 2022 study.

The amount of coal consumed by the bloc rose from 449 million tons in 2021 to 478 million tons in 2022 due to rising demand for coal in electricity production.

Coal consumption up

Over the past 30 years, the share of coal-fired power plants, which in 1990 provided 40% of the EU's electricity, has fallen. In 2020, just 13% of the bloc’s energy was produced using coal.

By 2021, around half of Europe’s 324 coal-fueled power plants had either closed or announced a retirement date before 2030.

Bruegel data shows that electricity generated by coal-fired power plants in the EU and UK declined by more than 40% between 2015 and 2020.

But the use of coal in power production is predicted to reach 20% in 2022 due to the rising demand for coal brought on by the energy crisis.

Some EU countries have stepped up efforts in coal and mining to find a remedy to this crisis.

Production from already existing coal mines has been increased, while some countries including the UK and Poland have also started new coal mine projects.

Countries including Germany, France, the UK, Netherlands, Spain, Italy, Greece, Hungary, and Austria have taken steps to extend the life of coal-fired power plants, re-commissioning power plants that were once shut down, and boosting current production.

Germany

Germany had previously announced a plan to shut down coal-fired power plants in 2038, but in 2021 the nation made agreements with several power plant operators to bring this deadline forward to 2030.

Bringing the target date for the end of coal use from 2038 to 2030 was among the key 2021 election pledges of the German coalition government.

Following the energy crisis in Europe brought on by the Russia-Ukraine conflict, Germany decided to reignite its domestic coal industry while searching for alternate energy sources since it was unable to get natural gas from Russia.

The government opted to keep using coal power plants to lessen its reliance on Russia following the war even if it had previously pledged to stop using them.

It took measures to extend the life of several coal-fired power facilities by reconnecting them to the grid.

The government decided to keep coal power facilities with a production capacity of over 6 gigawatt-hours as emergency reserves.

German energy company RWE announced that it would reopen three lignite facilities in Neurath and NiederauBem.

France

France ordered its primary electricity generation and distribution company GazelEnerji to put a coal power plant in Moselle back into service.

The power plant with a total electricity generation capacity of 600 megawatt-hours will continue to operate for some time due to the energy crisis.

Italy

The Italian government postponed the shutdown of six coal power plants that were scheduled to be disabled in 2025 and decided to restore a previously terminated facility to be temporarily used in case of an emergency.

Spain

In Spain, energy firm Endesa has been asked to reschedule the shutdown of its As Pontes coal plant.

Britain

The European energy crisis has also changed the approach towards coal investments in the UK, where these projects had been put on hold due to opposition from environmentalists.

The country has extended the life span of some coal power plants. To prolong the operational life of 2 different coal power plants, contracts were struck with the firms Drax and EDF.

The government and Uniper also came to an arrangement to keep the Ratcliffe coal plant operating, a plant previously agreed to terminate in 2022.

Also, the UK approved a new coal mining proposal for the first time in 30 years. The mine in the northwestern Cumbria area will be used for steel production, not power.

Poland

Despite efforts to switch to sustainable energy, Poland, one of the EU's top coal producers and consumers, boosted its coal consumption during the Russia-Ukraine war.

It halted natural gas and coal purchases from Russia but increased its coal imports from Colombia, Kazakhstan, South Africa, Australia, and Indonesia.

The government temporarily shelved its earlier ruling to ban lignite use for residential heating and decided to boost its coal production.

Full story

4) Half of green claims used to sell products in EU are misleading, Brussels finds

Financial Times, 12 January 2023

Half of the environmental claims used to advertise products in the EU are misleading or unfounded, Brussels has found as it prepares to introduce rules to prevent greenwashing claims.

In the latest draft of the proposals, seen by the Financial Times, the European Commission said it had found that 53 per cent of hundreds of claims assessed in 2020 gave “vague, misleading or unfounded information about products’ environmental characteristics”.

The new rules aim to provide a standardised framework to assess the environmental impacts of products and substantiate claims such as “100 per cent recycled” or made from “all natural” ingredients.

The initiative is part of a rapid rollout by the EU of legislation that includes regulations on packaging waste and the repairability of laptops and phones, to encourage more sustainable consumption within the bloc.

“By fighting greenwashing, the proposal will ensure a level playing field for businesses when marketing their greenness,” the draft said. “Climate-related claims have been shown to be particularly prone to being unclear and ambiguous and to mislead consumers, amounting to greenwashing.”

The commission declined to comment on the draft or when the rules might be introduced.

Full story

5) Electric car makers put the brakes on UK production because many drivers think the vehicles are too expensive

Daily Mail, 11 January 2023

In the latest draft of the proposals, seen by the Financial Times, the European Commission said it had found that 53 per cent of hundreds of claims assessed in 2020 gave “vague, misleading or unfounded information about products’ environmental characteristics”.

The new rules aim to provide a standardised framework to assess the environmental impacts of products and substantiate claims such as “100 per cent recycled” or made from “all natural” ingredients.

The initiative is part of a rapid rollout by the EU of legislation that includes regulations on packaging waste and the repairability of laptops and phones, to encourage more sustainable consumption within the bloc.

“By fighting greenwashing, the proposal will ensure a level playing field for businesses when marketing their greenness,” the draft said. “Climate-related claims have been shown to be particularly prone to being unclear and ambiguous and to mislead consumers, amounting to greenwashing.”

The commission declined to comment on the draft or when the rules might be introduced.

Full story

5) Electric car makers put the brakes on UK production because many drivers think the vehicles are too expensive

Daily Mail, 11 January 2023

Makers of electric cars are slowing down UK production as the vehicles are too expensive for many motorists.

It is now expected that the UK will produce 280,000 fully electric cars and vans in 2025, down from previous estimates of 360,000.

The forecast means only a quarter of car output will be electric within the next two years, lower than prior forecasts of more than a third.

In its latest report, the Advanced Propulsion Centre, which provides taxpayer funding to makers of zero-emissions vehicles, said the ‘uncertain economy’ was expected to push drivers towards cheaper car models for a longer period.

It added that the phenomenon was not unique to the UK, with electric vehicle production across Europe predicted to be 12 million, 1 million less than previous estimates.

The slowdown comes as prospective buyers see their budgets hammered by the cost of living squeeze and inflation.

Full story

6) Green Britain: People running out of energy credit every 10 seconds

BBC News, 12 January 2023

It is now expected that the UK will produce 280,000 fully electric cars and vans in 2025, down from previous estimates of 360,000.

The forecast means only a quarter of car output will be electric within the next two years, lower than prior forecasts of more than a third.

In its latest report, the Advanced Propulsion Centre, which provides taxpayer funding to makers of zero-emissions vehicles, said the ‘uncertain economy’ was expected to push drivers towards cheaper car models for a longer period.

It added that the phenomenon was not unique to the UK, with electric vehicle production across Europe predicted to be 12 million, 1 million less than previous estimates.

The slowdown comes as prospective buyers see their budgets hammered by the cost of living squeeze and inflation.

Full story

6) Green Britain: People running out of energy credit every 10 seconds

BBC News, 12 January 2023

The charity estimates that 3.2 million people in Britain ran out of credit on their prepayment meter last year, the equivalent of one every 10 seconds.

Audrey Ridson, 81, was switched to one even though she could not walk to the shop to top up her energy card.

Ministers said that energy firms must offer help to those struggling.

Some have meters installed, while others have smart meters automatically switched to prepayment mode.

People using prepayment meters pay for their gas and electricity by topping up their meter, either through accounts or by adding credit to a card in a convenience store or post office.

This is a more expensive method of paying than by direct debit, but is sometimes the only option for people who have struggled to pay and are in debt to an energy supplier. Many rented properties also have prepayment meters.

Problems can arise when residents no longer have any credit left on the meter, and have no money to top it up - leaving them unable to cook or heat their homes.

Full story

7) Ben Marlow: Britain's electric car dream is all but over

The Daily Telegraph, 12 January 2023

Britishvolt’s chances of success are fanciful despite expectations of a last-ditch bailout

If Britain is good at one thing, it is inventing a brilliant product, turning it into a great business, and then selling it to a foreign buyer before it has had a chance to reach its true potential. When it comes to letting our best companies and technology disappear abroad, and by extension the associated profits, intellectual property and tax base, the UK truly is a world-beater.

Yet, in what may be something of a first, electric battery hopeful Britishvolt looks poised to skip the middle part entirely, offloading what is little more than a nice idea to an overseas investor without any of the success in the middle.

A start-up that claimed to be worth nearly £800m this time last year is on the verge of being rescued by an obscure Indonesian outfit for just £32m. If there is a major business that has unravelled at greater speed, it is genuinely hard to think of one.

This is a company, after all, whose arrival in the North East’s industrial heartlands was widely heralded as one of the best things to ever happen to the region – and indeed to a car industry in desperate need of a reliable, domestic source of batteries if full electrification is to become a reality. Credulous backers include blue-chip names such Glencore and Ashtead, who should have known better – and, somewhat inevitably, those at the very top of government, who never do.

In many ways, the fanfare that greeted Britishvolt’s plans typified the Boris Johnson era of grand announcements that were big on bluster but remarkably short on detail, and almost entirely devoid of substance. With what amounted to little more than a PowerPoint presentation and planning permission, Britishvolt somehow managed to persuade a lot of people that it could build a giant gigafactory on the site of a decommissioned coal-fired power station near Blyth, on the Northumbrian coast.

What’s more, once up and running, it would churn out enough batteries every year to power 300,000 cars, a figure that was all the more remarkable given that the battery factory Nissan has earmarked for its Sunderland heartlands is expected to produce 100,000.

Warehouse provider Tritax and investment house abrdn agreed to provide £1.7bn of capital to construct the plant – a quite staggering sum given that this was a business with no technology or physical assets, little in the way of additional funding, and critically, not a single customer.

There was the promise, too, of government investment – £100m from the Automotive Transformation Fund, a state scheme set up to try and entice battery-makers to these shores to fuel a home-grown electric car industry. Yet that was contingent on Britishvolt actually starting construction work, which it still hasn’t.

Chairman Peter Rolton described its plans as a “first step in creating a commercialised battery ecosystem” for the UK. The then business secretary Kwasi Kwarteng said the plant would help the UK “fully capture the benefits of a booming electric vehicle market”. Johnson, never one to miss the opportunity to leap aboard a passing bandwagon, called it “fantastic news” for “our Green Industrial Revolution”.

In an area still reeling from the collapse of Redcar steelworks, and the implosion of Sirius Minerals, which hoped to build a giant potash mine under North York Moors national park, but succeeding in only creating a giant financial hole, this was levelling up in green overalls. The company promised to create 3,000 jobs and to prioritise locals in its recruitment drive. A further 5,000 would be added via the surrounding supply chain, it claimed.

If Britishvolt’s chances of success seemed far-fetched from the outset, then they seem positively fanciful today despite expectations of a last-ditch bailout. For a start, this is a deal that could yet fall apart because it needs the approval of three quarters of existing shareholders, and they stand to be all but wiped out, receiving as little as 13p in the pound.

Secondly, its prospective new owners are an unknown quantity and what is known about them isn’t exactly grounds for reassurance that they can succeed where Britishvolt, with some serious know-how and deep pockets behind it, has already failed. The UK accounts of finance house and lead investor DeaLab are overdue, according to Companies House, while the most recent filing in 2021 claims the business is dormant and has assets of just £5m, the Financial Times reports.

And it doesn’t change the giant flaw at the heart of Britishvolt’s plans, which is that it has adopted a “cart before the horse “ approach of trying to stimulate demand by creating supply. This is the wrong way round and almost never works.

Whatever the outcome, the entire saga is undoubtedly a serious blow to the company, but it is a setback for Blyth and the surrounding area, and even more so for Britain’s hopes of building a world-beating electric car industry capable of sustaining the shift from petrol and diesel vehicles to cleaner models.

With the UK suffering from a serious deficiency in other vital infrastructure such as charging points, and the grid itself, at the same time as enlisting plucky opportunists to lead the way, it will slip even further behind the likes of China, America, and Germany.

Rooting for the underdog is a commendable trait but it is no substitute for genuine know-how and a real strategy. Daydreams and rhetoric won’t solve Britain’s electric car problem.

If Britain is good at one thing, it is inventing a brilliant product, turning it into a great business, and then selling it to a foreign buyer before it has had a chance to reach its true potential. When it comes to letting our best companies and technology disappear abroad, and by extension the associated profits, intellectual property and tax base, the UK truly is a world-beater.

Yet, in what may be something of a first, electric battery hopeful Britishvolt looks poised to skip the middle part entirely, offloading what is little more than a nice idea to an overseas investor without any of the success in the middle.

A start-up that claimed to be worth nearly £800m this time last year is on the verge of being rescued by an obscure Indonesian outfit for just £32m. If there is a major business that has unravelled at greater speed, it is genuinely hard to think of one.

This is a company, after all, whose arrival in the North East’s industrial heartlands was widely heralded as one of the best things to ever happen to the region – and indeed to a car industry in desperate need of a reliable, domestic source of batteries if full electrification is to become a reality. Credulous backers include blue-chip names such Glencore and Ashtead, who should have known better – and, somewhat inevitably, those at the very top of government, who never do.

In many ways, the fanfare that greeted Britishvolt’s plans typified the Boris Johnson era of grand announcements that were big on bluster but remarkably short on detail, and almost entirely devoid of substance. With what amounted to little more than a PowerPoint presentation and planning permission, Britishvolt somehow managed to persuade a lot of people that it could build a giant gigafactory on the site of a decommissioned coal-fired power station near Blyth, on the Northumbrian coast.

What’s more, once up and running, it would churn out enough batteries every year to power 300,000 cars, a figure that was all the more remarkable given that the battery factory Nissan has earmarked for its Sunderland heartlands is expected to produce 100,000.

Warehouse provider Tritax and investment house abrdn agreed to provide £1.7bn of capital to construct the plant – a quite staggering sum given that this was a business with no technology or physical assets, little in the way of additional funding, and critically, not a single customer.

There was the promise, too, of government investment – £100m from the Automotive Transformation Fund, a state scheme set up to try and entice battery-makers to these shores to fuel a home-grown electric car industry. Yet that was contingent on Britishvolt actually starting construction work, which it still hasn’t.

Chairman Peter Rolton described its plans as a “first step in creating a commercialised battery ecosystem” for the UK. The then business secretary Kwasi Kwarteng said the plant would help the UK “fully capture the benefits of a booming electric vehicle market”. Johnson, never one to miss the opportunity to leap aboard a passing bandwagon, called it “fantastic news” for “our Green Industrial Revolution”.

In an area still reeling from the collapse of Redcar steelworks, and the implosion of Sirius Minerals, which hoped to build a giant potash mine under North York Moors national park, but succeeding in only creating a giant financial hole, this was levelling up in green overalls. The company promised to create 3,000 jobs and to prioritise locals in its recruitment drive. A further 5,000 would be added via the surrounding supply chain, it claimed.

If Britishvolt’s chances of success seemed far-fetched from the outset, then they seem positively fanciful today despite expectations of a last-ditch bailout. For a start, this is a deal that could yet fall apart because it needs the approval of three quarters of existing shareholders, and they stand to be all but wiped out, receiving as little as 13p in the pound.

Secondly, its prospective new owners are an unknown quantity and what is known about them isn’t exactly grounds for reassurance that they can succeed where Britishvolt, with some serious know-how and deep pockets behind it, has already failed. The UK accounts of finance house and lead investor DeaLab are overdue, according to Companies House, while the most recent filing in 2021 claims the business is dormant and has assets of just £5m, the Financial Times reports.

And it doesn’t change the giant flaw at the heart of Britishvolt’s plans, which is that it has adopted a “cart before the horse “ approach of trying to stimulate demand by creating supply. This is the wrong way round and almost never works.

Whatever the outcome, the entire saga is undoubtedly a serious blow to the company, but it is a setback for Blyth and the surrounding area, and even more so for Britain’s hopes of building a world-beating electric car industry capable of sustaining the shift from petrol and diesel vehicles to cleaner models.

With the UK suffering from a serious deficiency in other vital infrastructure such as charging points, and the grid itself, at the same time as enlisting plucky opportunists to lead the way, it will slip even further behind the likes of China, America, and Germany.

Rooting for the underdog is a commendable trait but it is no substitute for genuine know-how and a real strategy. Daydreams and rhetoric won’t solve Britain’s electric car problem.

8) Windfarms receive £227million subsidies to switch off

The Herald, 11 January 2023

The Herald, 11 January 2023

Two huge new offshore windfarms received nearly half of the £227million paid out to operators last year to switch off when it was too windy due to capacity issues with the grid.

Constraint payments are given to operators for switching off turbines, typically when high winds and a high concentration of wind farms means the system doesn't have the capacity to transport the energy to where it is needed.

The cost is added to domestic electricity bills, heaping more misery on households already grappling with soaring energy bills.

According to Net Zero Watch, much of the increase in payments has been driven by the commissioning of two Scottish offshore windfarms. Moray East and Beatrice, both on the Moray Firth, which are now receiving £100 million per year between them.

New analysis from Net Zero Watch has revealed that the cost of paying windfarms to "switch off" has soared, from £143 million in 2021 to £227 million in 2022, an increase of £84 million, or 60%.

There is criticism that government is not doing enough to solve the problem by adequately funding a solution to the 'switch offs' - involving the creation of energy storage technologies.

The Scottish Government says it plays no role in constraint payments and that Lack of grid capacity is "holding back our ability to bring on cheap, renewable sources of electricity generation."

Windfarms have been the dominant weapon in the UK and Scottish governments’ armoury against climate change for years.

It is estimated that Scotland is home to just over half of the wind power generation in the UK.

The Herald revealed last year that constraint payments have cost bill-payers approaching £1bn in just over five years and are expected to soar to £500m a year.

Net Zero Watch,which scrutinises climate and decarbonisation policies, says the figures are symptomatic of problems with the governance of the electricity system and the way renewables have been rolled out before the grid was ready to take them.

Andrew Montford, deputy director of the group, said: "Essentially the system is very badly designed.

"We have gone ahead and we have let these people build these windfarm before the capacity is there to deliver the power.

"There are not enough wires between Scotland - where these big windfarms are - and England where the demand is.

"Back in the old days when this process started, owner would have said we are not going to build a windfarm in the hope that you are going to build more wires across the border so they [the government] said okay we will compensate you.

"So even if the grid can't take the power we will compensate you [and] ultimately the man on the street pays for everything.

"The problem is, if you have a windfarm in the Moray Firth scheduled to deliver power down south and there's not enough capacity you have not only got to compensate the windfarm for having to switch off but you also have to pay someone south of the border to switch on."

There are also suspicions that the two Scottish windfarms are taking advantage of a legal loophole in the system that allows generators to be paid twice for the same electricity.

"Although constraints payments are widely understood as a payment to switch off, in fact the rules only require generators to keep the power away from the transmission grid," explained Mr Montford.

"If they can divert it elsewhere, for example to a battery, they can receive the constraint payment and still sell the power."

Net Zero Watch revealed the existence of the constraint payment loophole last year. There is no suggestion that either windfarm is doing anything illegal but the issue has been brought to the attention of Ofgem.

Dr Benny Peiser, director of the group, said: "Whether through utter incompetence, or shameful cynicism, the Government, National Grid and Ofgem have put in place an electricity system that allows renewables operators to rip off the consumer left, right and centre.

"They seem to hold UK households and businesses in contempt."

Moray East only became fully operational in 2022, so analysts say its 2023 constraint income is likely to be higher still.

Full story

Constraint payments are given to operators for switching off turbines, typically when high winds and a high concentration of wind farms means the system doesn't have the capacity to transport the energy to where it is needed.

The cost is added to domestic electricity bills, heaping more misery on households already grappling with soaring energy bills.

According to Net Zero Watch, much of the increase in payments has been driven by the commissioning of two Scottish offshore windfarms. Moray East and Beatrice, both on the Moray Firth, which are now receiving £100 million per year between them.

New analysis from Net Zero Watch has revealed that the cost of paying windfarms to "switch off" has soared, from £143 million in 2021 to £227 million in 2022, an increase of £84 million, or 60%.

There is criticism that government is not doing enough to solve the problem by adequately funding a solution to the 'switch offs' - involving the creation of energy storage technologies.

The Scottish Government says it plays no role in constraint payments and that Lack of grid capacity is "holding back our ability to bring on cheap, renewable sources of electricity generation."

Windfarms have been the dominant weapon in the UK and Scottish governments’ armoury against climate change for years.

It is estimated that Scotland is home to just over half of the wind power generation in the UK.

The Herald revealed last year that constraint payments have cost bill-payers approaching £1bn in just over five years and are expected to soar to £500m a year.

Net Zero Watch,which scrutinises climate and decarbonisation policies, says the figures are symptomatic of problems with the governance of the electricity system and the way renewables have been rolled out before the grid was ready to take them.

Andrew Montford, deputy director of the group, said: "Essentially the system is very badly designed.

"We have gone ahead and we have let these people build these windfarm before the capacity is there to deliver the power.

"There are not enough wires between Scotland - where these big windfarms are - and England where the demand is.

"Back in the old days when this process started, owner would have said we are not going to build a windfarm in the hope that you are going to build more wires across the border so they [the government] said okay we will compensate you.

"So even if the grid can't take the power we will compensate you [and] ultimately the man on the street pays for everything.

"The problem is, if you have a windfarm in the Moray Firth scheduled to deliver power down south and there's not enough capacity you have not only got to compensate the windfarm for having to switch off but you also have to pay someone south of the border to switch on."

There are also suspicions that the two Scottish windfarms are taking advantage of a legal loophole in the system that allows generators to be paid twice for the same electricity.

"Although constraints payments are widely understood as a payment to switch off, in fact the rules only require generators to keep the power away from the transmission grid," explained Mr Montford.

"If they can divert it elsewhere, for example to a battery, they can receive the constraint payment and still sell the power."

Net Zero Watch revealed the existence of the constraint payment loophole last year. There is no suggestion that either windfarm is doing anything illegal but the issue has been brought to the attention of Ofgem.

Dr Benny Peiser, director of the group, said: "Whether through utter incompetence, or shameful cynicism, the Government, National Grid and Ofgem have put in place an electricity system that allows renewables operators to rip off the consumer left, right and centre.

"They seem to hold UK households and businesses in contempt."

Moray East only became fully operational in 2022, so analysts say its 2023 constraint income is likely to be higher still.

Full story

9) Ralph Schoellhammer: The German Greens are playing into Russia’s hands

Unherd, 12 January 2023

Unherd, 12 January 2023

The push for clean energy may, perversely, lead to more demand for Russian gas

Throughout German history, reality has been a nuisance to be dealt with, not a fact to be faced. As the philosopher Hegel once quipped, “if facts contradict to my theory, the worse for the facts”.

This tradition continues to this day. At the time of writing, members of the Green Party are protesting the expansion of coal mining around the village of Lützerath, demanding an end to the use of coal for energy production. The expansion of mining, however, was approved by the German Federal Minister for Economic Affairs and Climate Action, Robert Habeck — who is of course himself a member of the Greens. Confronted with this contradiction, and the argument that the expansion of coal was necessary to compensate the decline of nuclear energy, a Green member of the German Bundestag clarified that the party base wants neither coal nor nuclear.

Unfortunately her interlocutor did not ask where the future energy is supposed to come from, so let’s dig into the topic: in 2021 coal (both bituminous and lignite) contributed 28.1% to Germany’s electricity production, while nuclear contributed 11.8%. This means that over the next 10 to 15 years 39.9% of electricity production needs to be replaced just to keep supply stable (some Green politicians are pushing for an even shorter period until 2030). Renewables contribute 39.7% to electricity production, meaning that their actual output (not the installed capacity, which needs to grow even faster due to lower capacity factors for wind and solar compared to coal and nuclear) has to double.

But that is only half the story: Germany wants to shift quickly to EVs and replace heating via fossil fuels with heat pumps — proposals that will massively increase the demand for electricity. According to the Federal Association of Energie- and Hydroeconomics, Germany will need 700TWh of electricity by 2030, which is an increase by 20% compared to 2021.

To sum up, Germany is faced with the prospect of reducing electricity supply by almost 40% while demand is estimated to increase by 20%. So how does the government plan to solve this problem? According to recent reports, by doubling gas firing capacity (from currently 15% to 30%), which of course begs the question of where that gas will be coming from. Supposedly LNG will be the answer, but it is questionable whether Qatar, the US, and other LNG exporters will be capable of satisfying this increasing demand, given the ambitious timetable put forward by the German government. As analysts like Tracy Shuchart of Hightower Resource Advisory have pointed out, at current export capacity the US cannot even fulfill the LNG export contracts that Europe has already signed.

There is, however, an alternative that currently nobody dares to speak of. This alternative, of course, is Russia. How long would it take for Berlin to restart Russian gas imports if a Russian-Ukrainian ceasefire was agreed? The energy question at least partly explains Germany’s lacklustre support for Ukraine. But the true irony is that the party most supportive of Ukraine’s struggle against Russia’s aggression could be responsible for forcing Germany back into the Russian embrace. In a sense, the Green Party and their policy of contradictions have made them the quintessential German party: Hegel would be proud.

Throughout German history, reality has been a nuisance to be dealt with, not a fact to be faced. As the philosopher Hegel once quipped, “if facts contradict to my theory, the worse for the facts”.

This tradition continues to this day. At the time of writing, members of the Green Party are protesting the expansion of coal mining around the village of Lützerath, demanding an end to the use of coal for energy production. The expansion of mining, however, was approved by the German Federal Minister for Economic Affairs and Climate Action, Robert Habeck — who is of course himself a member of the Greens. Confronted with this contradiction, and the argument that the expansion of coal was necessary to compensate the decline of nuclear energy, a Green member of the German Bundestag clarified that the party base wants neither coal nor nuclear.

Unfortunately her interlocutor did not ask where the future energy is supposed to come from, so let’s dig into the topic: in 2021 coal (both bituminous and lignite) contributed 28.1% to Germany’s electricity production, while nuclear contributed 11.8%. This means that over the next 10 to 15 years 39.9% of electricity production needs to be replaced just to keep supply stable (some Green politicians are pushing for an even shorter period until 2030). Renewables contribute 39.7% to electricity production, meaning that their actual output (not the installed capacity, which needs to grow even faster due to lower capacity factors for wind and solar compared to coal and nuclear) has to double.

But that is only half the story: Germany wants to shift quickly to EVs and replace heating via fossil fuels with heat pumps — proposals that will massively increase the demand for electricity. According to the Federal Association of Energie- and Hydroeconomics, Germany will need 700TWh of electricity by 2030, which is an increase by 20% compared to 2021.

To sum up, Germany is faced with the prospect of reducing electricity supply by almost 40% while demand is estimated to increase by 20%. So how does the government plan to solve this problem? According to recent reports, by doubling gas firing capacity (from currently 15% to 30%), which of course begs the question of where that gas will be coming from. Supposedly LNG will be the answer, but it is questionable whether Qatar, the US, and other LNG exporters will be capable of satisfying this increasing demand, given the ambitious timetable put forward by the German government. As analysts like Tracy Shuchart of Hightower Resource Advisory have pointed out, at current export capacity the US cannot even fulfill the LNG export contracts that Europe has already signed.

There is, however, an alternative that currently nobody dares to speak of. This alternative, of course, is Russia. How long would it take for Berlin to restart Russian gas imports if a Russian-Ukrainian ceasefire was agreed? The energy question at least partly explains Germany’s lacklustre support for Ukraine. But the true irony is that the party most supportive of Ukraine’s struggle against Russia’s aggression could be responsible for forcing Germany back into the Russian embrace. In a sense, the Green Party and their policy of contradictions have made them the quintessential German party: Hegel would be proud.

10) Marian L. Tupy: Why is Paul Ehrlich so hard to ignore?

The Wall Street Journal, 13 January 2023

The Wall Street Journal, 13 January 2023

Blame evolution, which primes us to be alert to danger, even when we know better.

Paul Ehrlich’s memoir, “Life: A Journey through Science and Politics,” comes out next week. It probably won’t sell as many copies as “The Population Bomb” (1968). But neither will it flop—and it should. Mr. Ehrlich, 90, whom the media treat with an obsequious deference—see the recent cringe-worthy segment on CBS’s “60 Minutes”—will again profit from the capitalist consumption he’s spent his life decrying.

Mr. Ehrlich is a purveyor of “doom porn” at a time when the world has never been more prosperous. Developed countries are astonishingly rich, and even in developing nations the share of the population in absolute poverty has fallen to single digits. Mr. Ehrlich in 1968 predicted mass starvation; instead obesity is rising, even in Africa. So why don’t people ignore him? Ignorance is no excuse when we carry the entirety of human knowledge in our pockets.

The answer is that humans have evolved to prioritize bad news. “Organisms that treat threats as more urgent than opportunities,” wrote Nobel Prize-winning behavioral psychologist Daniel Kahneman, “have a better chance to survive and reproduce.”

As Peter H. Diamandis and Steven Kotler explain in “Abundance: The Future Is Better Than You Think,” our brains have limited bandwidth and need to focus when a threat arises. Most information is first sifted through the amygdala, a part of the brain that is “responsible for primal emotions like rage, hate, and fear,” Messrs. Diamandis and Kotler write. “The amygdala is always looking for something to fear.”

That is a very powerful impulse that can deceive even the most dispassionate and rational observers. A study by Marc Trussler and Stuart Soroka found that even when people expressly say they are interested in more good news, eye-tracking experiments show they are in fact much more interested in bad news.

Mr. Ehrlich built a career pandering to these inclinations, starting with “The Population Bomb.” In 1970 he said that “if I were a gambler, I would take even money that England will not exist in the year 2000.” That got the attention of Julian Simon, a University of Maryland economist, who a decade later challenged Mr. Ehrlich to a wager.

It was structured as a commodities futures contract. Simon agreed to sell Mr. Ehrlich $200 each worth of chromium, copper, nickel, tin and tungsten in 1990 at 1980 prices. The bet would pay off for Mr. Ehrlich if the metals became scarcer and thus costlier. On the settlement date, the total price had declined from $1,000 to $423.93. Mr. Ehrlich mailed Simon a check for the balance, $576.07.

While issuing one failed prognostication after another, Mr. Ehrlich went on to win a series of prestigious prizes. When the MacArthur Foundation gave him a “genius grant” in 1990, Simon quipped: “MacArthur! I can’t even get a McDonald’s!”

What does Mr. Ehrlich’s memoir say about the bet? The book isn’t out, but its index is already available on Amazon. Simon’s name doesn’t appear.

Mr. Tupy is a senior fellow at the Cato Institute’s Center for Global Liberty and Prosperity and a co-author of “Superabundance: The Story of Population Growth, Innovation and Human Flourishing on an Infinitely Bountiful Planet.”

Paul Ehrlich’s memoir, “Life: A Journey through Science and Politics,” comes out next week. It probably won’t sell as many copies as “The Population Bomb” (1968). But neither will it flop—and it should. Mr. Ehrlich, 90, whom the media treat with an obsequious deference—see the recent cringe-worthy segment on CBS’s “60 Minutes”—will again profit from the capitalist consumption he’s spent his life decrying.

Mr. Ehrlich is a purveyor of “doom porn” at a time when the world has never been more prosperous. Developed countries are astonishingly rich, and even in developing nations the share of the population in absolute poverty has fallen to single digits. Mr. Ehrlich in 1968 predicted mass starvation; instead obesity is rising, even in Africa. So why don’t people ignore him? Ignorance is no excuse when we carry the entirety of human knowledge in our pockets.

The answer is that humans have evolved to prioritize bad news. “Organisms that treat threats as more urgent than opportunities,” wrote Nobel Prize-winning behavioral psychologist Daniel Kahneman, “have a better chance to survive and reproduce.”

As Peter H. Diamandis and Steven Kotler explain in “Abundance: The Future Is Better Than You Think,” our brains have limited bandwidth and need to focus when a threat arises. Most information is first sifted through the amygdala, a part of the brain that is “responsible for primal emotions like rage, hate, and fear,” Messrs. Diamandis and Kotler write. “The amygdala is always looking for something to fear.”

That is a very powerful impulse that can deceive even the most dispassionate and rational observers. A study by Marc Trussler and Stuart Soroka found that even when people expressly say they are interested in more good news, eye-tracking experiments show they are in fact much more interested in bad news.

Mr. Ehrlich built a career pandering to these inclinations, starting with “The Population Bomb.” In 1970 he said that “if I were a gambler, I would take even money that England will not exist in the year 2000.” That got the attention of Julian Simon, a University of Maryland economist, who a decade later challenged Mr. Ehrlich to a wager.

It was structured as a commodities futures contract. Simon agreed to sell Mr. Ehrlich $200 each worth of chromium, copper, nickel, tin and tungsten in 1990 at 1980 prices. The bet would pay off for Mr. Ehrlich if the metals became scarcer and thus costlier. On the settlement date, the total price had declined from $1,000 to $423.93. Mr. Ehrlich mailed Simon a check for the balance, $576.07.

While issuing one failed prognostication after another, Mr. Ehrlich went on to win a series of prestigious prizes. When the MacArthur Foundation gave him a “genius grant” in 1990, Simon quipped: “MacArthur! I can’t even get a McDonald’s!”

What does Mr. Ehrlich’s memoir say about the bet? The book isn’t out, but its index is already available on Amazon. Simon’s name doesn’t appear.

Mr. Tupy is a senior fellow at the Cato Institute’s Center for Global Liberty and Prosperity and a co-author of “Superabundance: The Story of Population Growth, Innovation and Human Flourishing on an Infinitely Bountiful Planet.”

The London-based Net Zero Watch is a campaign group set up to highlight and discuss the serious implications of expensive and poorly considered climate change policies. The Net Zero Watch newsletter is prepared by Director Dr Benny Peiser - for more information, please visit the website at www.netzerowatch.com.

No comments:

Post a Comment

Thank you for joining the discussion. Breaking Views welcomes respectful contributions that enrich the debate. Please ensure your comments are not defamatory, derogatory or disruptive. We appreciate your cooperation.