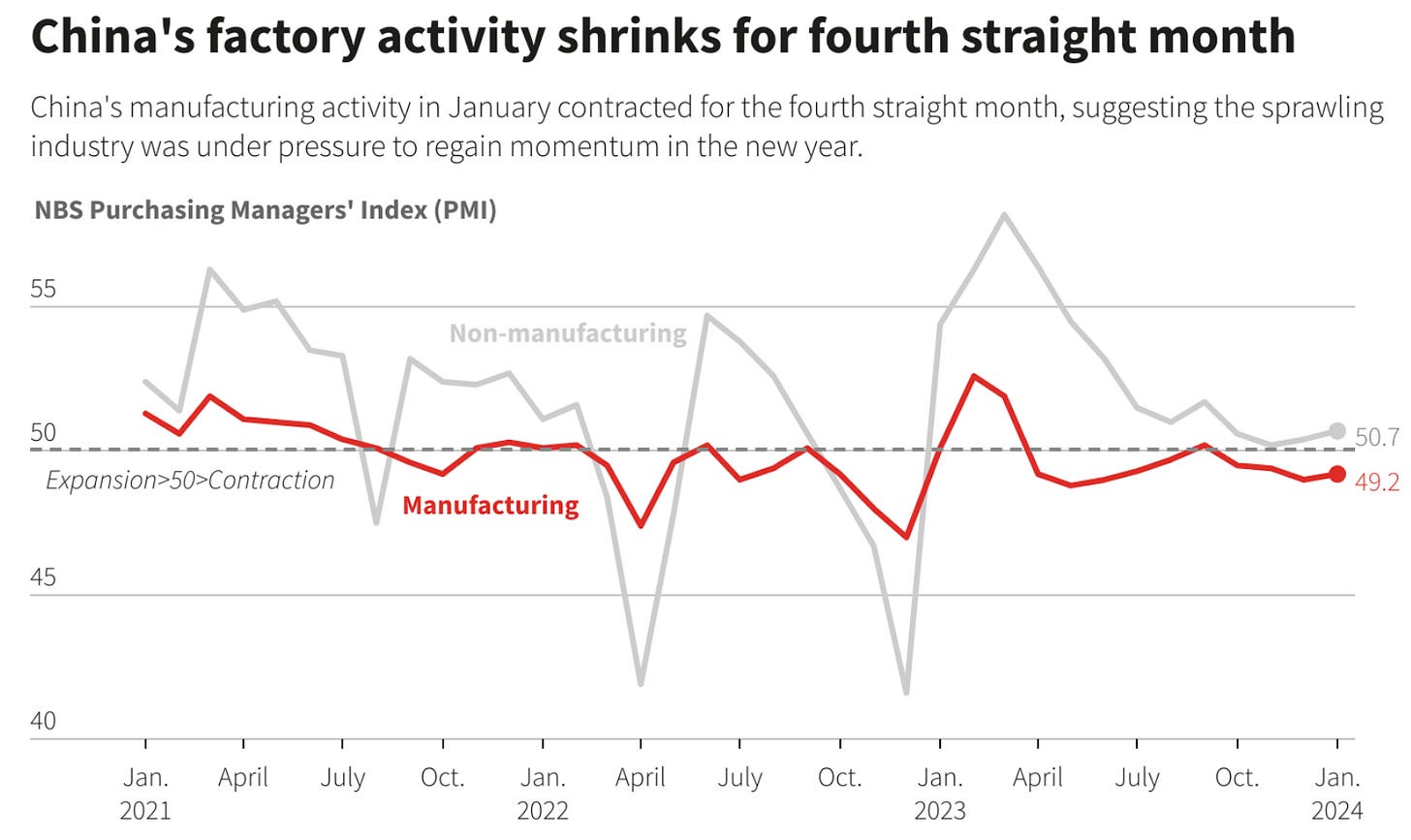

China is on the edge of recession — excluding Covid, for the first time since 2008 — as new data showed all-important manufacturing contracted for the fourth month in a row with particular weakness in new orders.

In other words, what they’ve got is backlog, then it's a cliff.

Manufacturing makes up a third of China’s economy — much more than the US. While the collapse in China property — another third of China’s economy — is adding fuel to the fire.

Offices Emptier than Covid

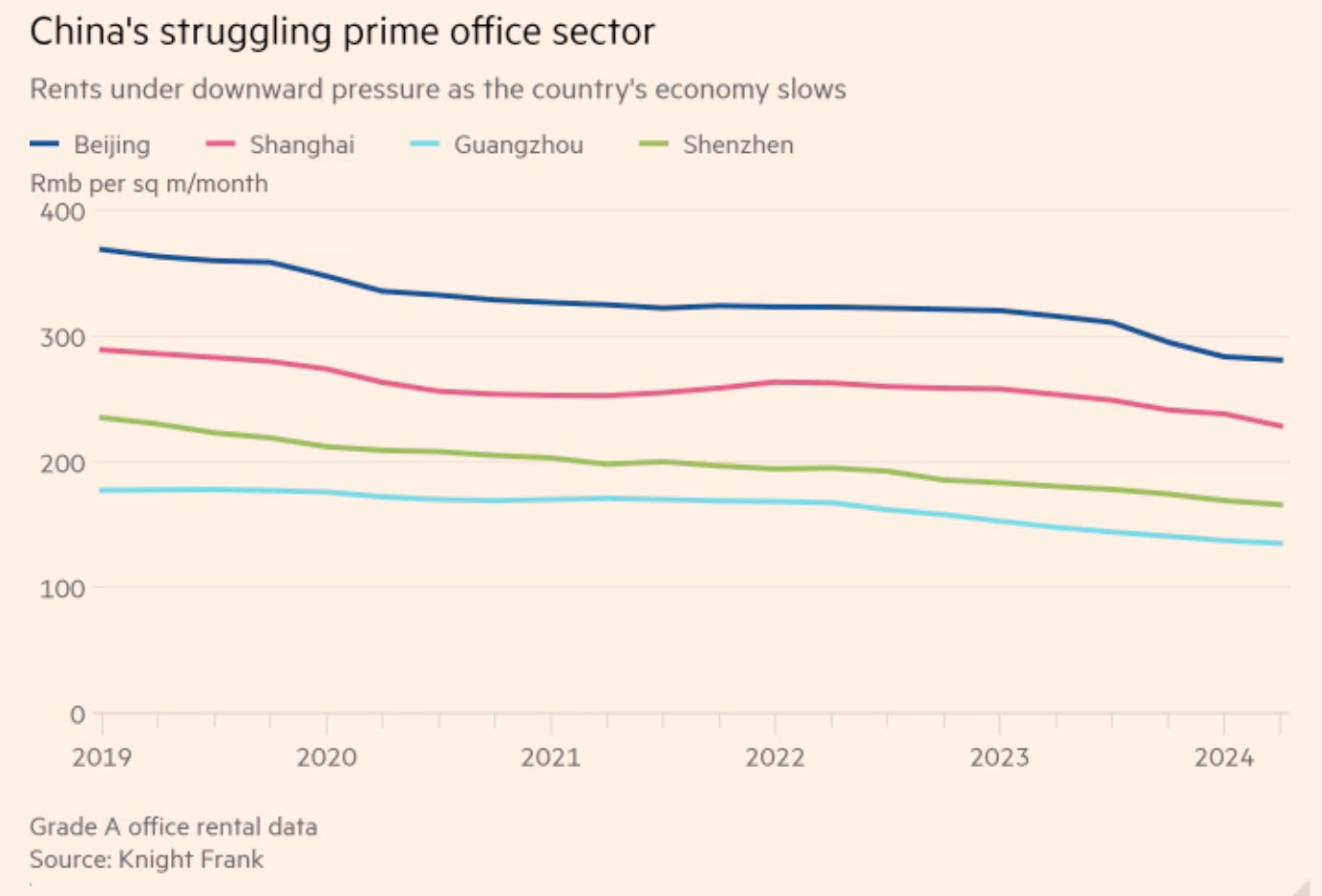

London's Financial Times reports that office buildings in China are emptier than they were during the Covid lockdowns. FT notes the whole work-at-home thing hasn't taken off in China, implying the main driver of empty offices is layoffs.

In Shanghai, office vacancies are at 21%. In Shenzhen, China's main export hub, vacancies are at 27%. These are both much worse than vacancies during Covid lockdowns.

Offices Emptier than Covid

London's Financial Times reports that office buildings in China are emptier than they were during the Covid lockdowns. FT notes the whole work-at-home thing hasn't taken off in China, implying the main driver of empty offices is layoffs.

In Shanghai, office vacancies are at 21%. In Shenzhen, China's main export hub, vacancies are at 27%. These are both much worse than vacancies during Covid lockdowns.

Click to view

To give a flavor, Shenzhen rents have collapsed 15% percent year on year.

Of course, China's official GDP numbers are immune from the storms, but then nobody believes them — not even in China.

Click to view

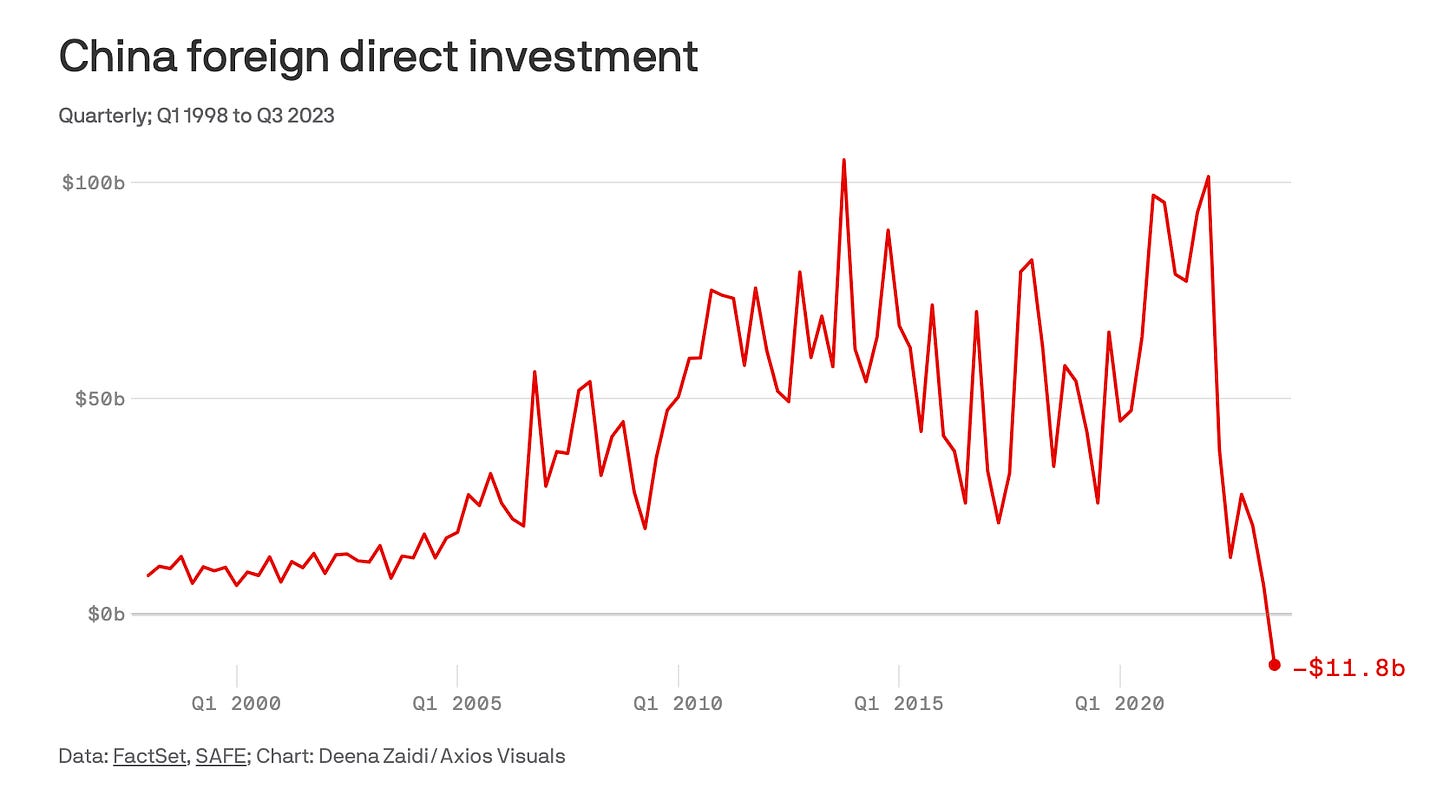

Interestingly, not all the layoffs are domestic companies: Foreign investment in China has plunged by a third in the past year as President Xi's authoritarianism is driving out foreign firms.

They’re vacating their Chinese offices and setting up shop in safer places like Vietnam or Mexico, with the factories to follow.

China’s Youth Crisis

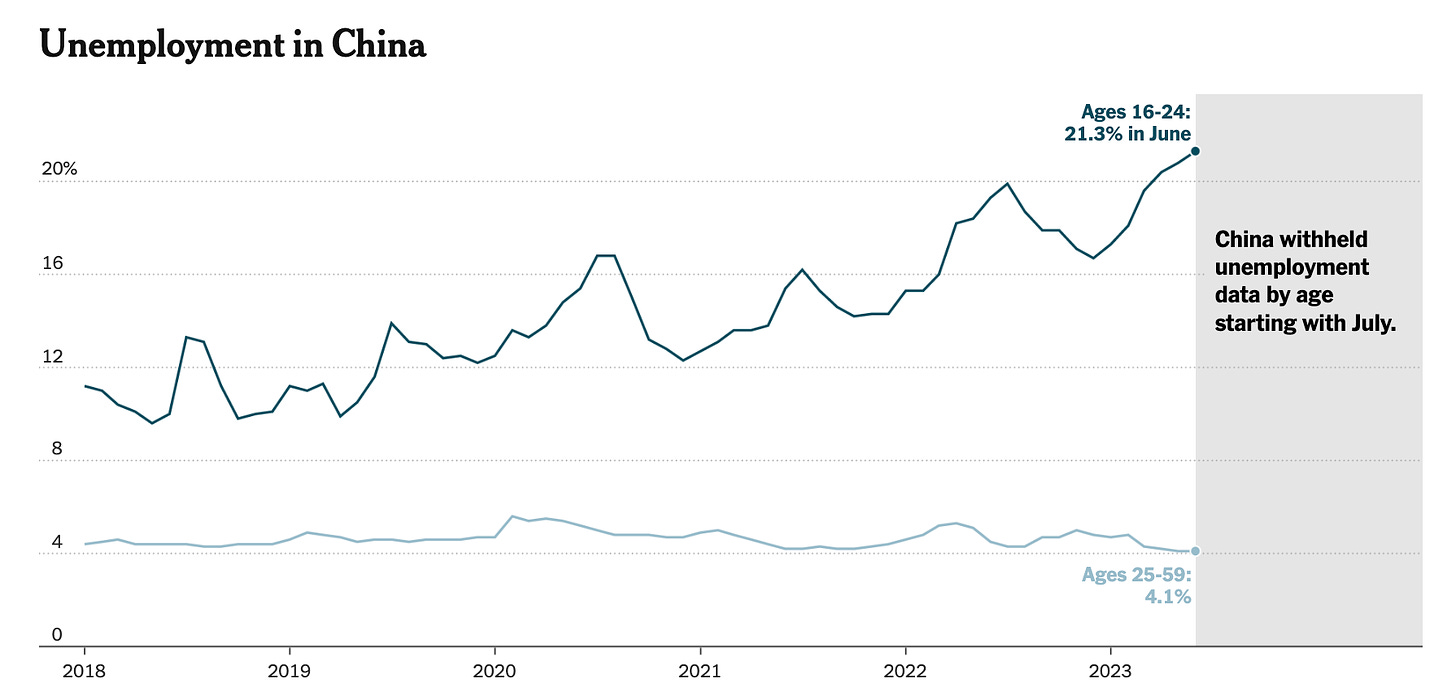

The contraction is hitting young Chinese hardest, with youth unemployment jumping to nearly one in four young Chinese without a job.

With a record 12 million Chinese college students about to graduate and hit the job market, they won’t like what they find.

Click to view

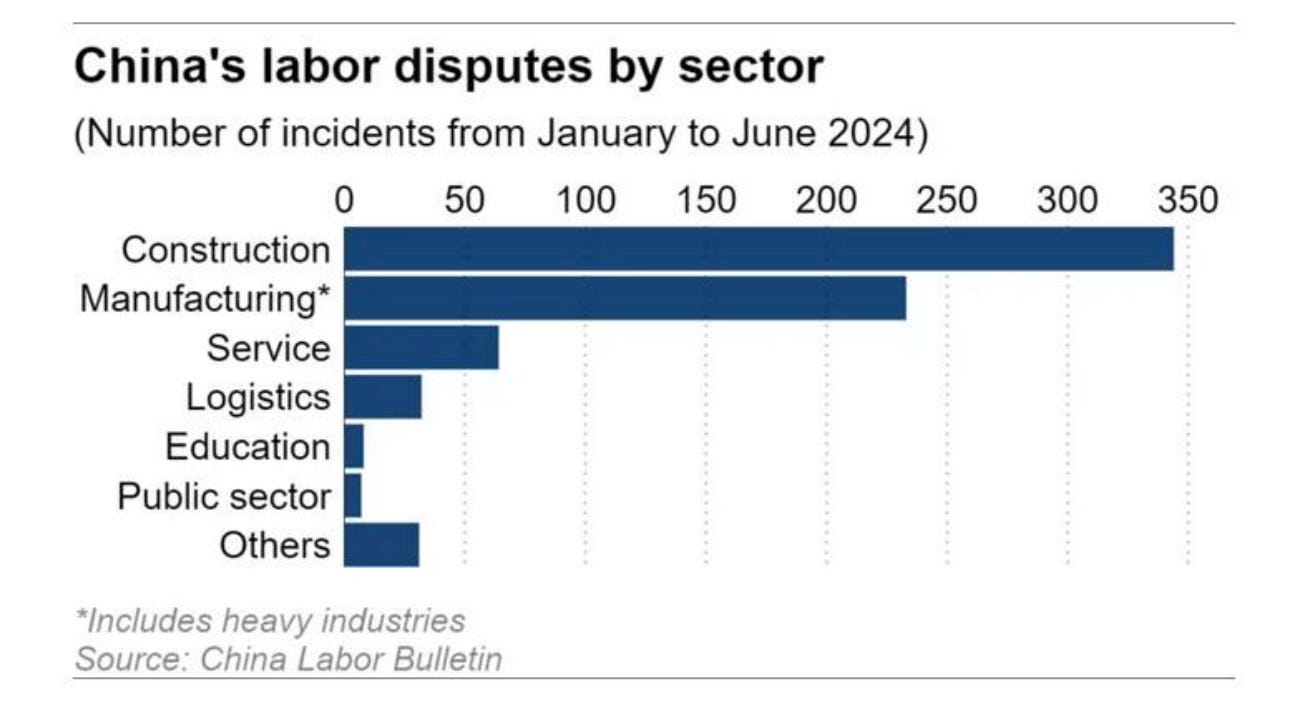

This is all, of course, social tinder. Public protests are now rising in China, with banners on overpasses demanding free elections and ex-soldiers accusing the government of "strangling" service-members.

Labor strikes have jumped, including 1,000 workers in a Nike sweatshop who, ironically, rose up after production was moved to Indonesia. Along with hundreds of strikes by unpaid construction workers as property developers collapse.

Click to view

The background here is hundreds of millions of Chinese work informally -- you need a kind of domestic passport to move to a big city where wages are decent, and most rural Chinese don't have one.

But you also need 15 years of formal work to get government pensions. That means for older workers, especially those without kids thanks to government birth controls, layoffs could mean literally starving in old age. They're desperate.

What went wrong with the Chinese miracle?

Growth under President Xi has collapsed to half its old rate -- China now grows like a normal middle-income country.

This is because the Mao-worshipping Xi cracked down on business -- even “disappearing” prominent businessmen like Ali Baba’s Jack Ma when they opposed Xi.

Click to view

Meanwhile, Xi plowed trillions into government-favored industries -- above all green energy and housing. These have both now collapsed with over-capacity and under-demand.

To illustrate, at one point China had nearly 1,500 electric car makers. Almost all have either gone bust or are in the process.

Meanwhile, housing has at least 5 and a half trillion dollars in bad loans, with millions of Chinese losing the half-built apartments they’d parked their life savings into as developers go under.

Between the housing collapse and stocks that have been flat since 2008, Chinese just don't have the money to keep spending, pulling down the economy even further.

What’s Next

Last time China hit recession, in 2008, Beijing dumped massive stimulus into the economy. This time, China's debt -- over $50 trillion -- has grown to the point it can't afford it.

And if China fails? The social contract in China is based on obedience for growth. If the government can't hold up growth, historically Chinese have gotten very kinetic. There's a reason Xi's been installing a police state, but of course if opposition is widespread enough even the police flip sides.

China could be in for a bumpy ride. And if it gets desperate and needs a nationalist distraction, it could pull Taiwan -- and America -- into the storm.

Peter St. Onge is a Mises Institute Associated Scholar and an Economic Research Fellow at the Heritage Foundation and a former professor at Taiwan’s Feng Chia University. This article was first published HERE

No comments:

Post a Comment

Thank you for joining the discussion. Breaking Views welcomes respectful contributions that enrich the debate. Please ensure your comments are not defamatory, derogatory or disruptive. We appreciate your cooperation.