Alcohol policy is always contentious – but let’s start with something that should be uncontroversial:

If the government wants to reduce alcohol-related harm, it should aim for measures that do more good than harm overall.

If a harm-reducing policy stacks up, it does so whether the overall social cost of alcohol is $10 billion, $1 billion, or $100 million.

If the benefits of the policy, including harm-reduction, exceed the costs of the policy, including impositions on harmless drinkers, the policy is a good idea.

What matters is cost-effectiveness. And the Alcohol Levy is meant to fund those kinds of cost-effective interventions.

There are a few more things that I think we should all be able to agree on. But if I don’t foreshadow the controversial parts, there is always a risk that people will stop reading. So here goes.

I have finally received a set of documents following Official Information Act requests that have been in progress since September 2023. It took the Ombudsman’s intervention.

The documents show that the initial scope for the independent review into the alcohol levy was partially motivated by a measure of the social cost of alcohol developed by BERL. As one of the consultants producing the report pointed out in an extensive critique, that measure, and the figures it produces, are flawed. But that critique was removed from the final report.

All in all, it looks like the Ministry of Health wants to promote a flawed and inflated measure of the social cost of alcohol to help it lobby for higher alcohol excise and for a higher levy.

This matters. The Ministry advises the Minister. The Minister makes decisions. If the Ministry ensured the deletion of material from a commissioned report contrary to the Ministry’s preferred view, that is a problem. It would be unbecoming of a Ministry presenting itself as a helpful servant to the Minister’s policy deliberations.

Alcohol faces two ‘taxes’. The government collects excise on alcohol that goes into government general revenues. It also collects a levy on alcohol that funds the Alcohol Levy Fund, used for harm-reduction activities by the Ministry of Health’s Health Promotion Agency.

Excise is $64.57 per litre of pure alcohol in spirits, meaning that $18.08 of the $56.99 price of a 700mL bottle of Kraken Rum (40% alcohol) is excise. The same $18.08 would apply on any 700mL bottle of 40% spirits, whether the cheapest vodka or the most expensive rare whisky: excise depends only on the quantity of pure alcohol in the bottle, but with a higher charge on spirits than on beer or wine. On 1 July, excise increases to $67.22 per litre of pure alcohol.

The Levy is much lower than excise. On spirits, it is currently about $0.13 per litre of pure alcohol – or about 4 cents on that bottle of rum.

The two charges serve different purposes.

If government wants to reduce overall alcohol consumption, or to raise revenue to offset its costs to the public health system or to police, a price instrument like excise is appropriate.

The best metastudy I have seen suggests that a 10% increase in the price of alcohol reduces overall consumption by about 4.4%, but only reduces heavy drinkers’ consumption by 2.8%.

This illustrates what a cumbersome tool excise is for dealing with harmful consumption. The person who drinks a bottle of whisky per day pays the same amount of excise, per bottle, as the person who drinks a bottle of whisky per year.

So, even if there were some way of getting a ‘right’ level of excise, on average, it would always overcharge harmless drinkers while undercharging those who cause harm.

In any case, the revenue raised by alcohol excise is not set aside for extra nighttime shifts for police or for accident and emergency departments.

Policy cannot solely rely on price measures like excise for addressing harms. It would be like trying to deal with street-racing and ram-raids by increasing petrol excise. In principle, there could be an excise level that would make street-racing unaffordable. But it wouldn’t be a good solution. It would impose too great a cost on those whose consumption is harmless.

The much-smaller levy, by contrast, directly funds harm-reduction programmes. And the government has been reviewing the levy. The Stage 1 Rapid Review was published in July 2023.

The Stage 1 Rapid Review

Unfortunately, we do not yet know whether any of the Levy’s funded projects are cost-effective.

The Stage One review noted that it was “not possible to quantify to what extent current levy investments reduce alcohol-related harm in the timeframe and with the material made available in stage 1 of this review.”

From the released documents, this appears to have been a down-scoping from the original work.

Chapter 5 of the Stage 1 Rapid Review was to have been titled “Effectiveness of harm reduction interventions”, with subsections on projects in health promotion, health protection, and community investment.

That was consistent with the original review scope, which included consideration of “the total levy fund and its impact on alcohol harm generally”.

In late February, a Manager for Alcohol Policy & Advice suggested revising the chapter heading to Evidence for harm reduction interventions, noting that it “is a slightly broader focus and would not preclude inclusion of evidence for effectiveness where this is available”.

Perhaps more detail on effectiveness of funded work will appear in the Stage Two review, reportedly due sometime this week. The Stage One review prudently recommended against increases in the alcohol levy until better evidence could be mustered.

Nevertheless, new alcohol levy rates were announced last week, taking effect from 1 July – an increase to $0.19 per litre levy on spirits.

It surely would have been better for public evidence of effectiveness to have preceded the levy announcement.

The Stage 1 Review and the Social Cost of Alcohol

The Review’s treatment of the overall social cost of alcohol was more worrying.

The initial scope for the review repeatedly highlighted BERL’s measure of the social cost of alcohol: $7.8 billion. BERL’s figure was cited in the purpose statement for the consultancy services order – it helped in motivating the review.

The Stage 1 review was meant to assess the social cost figure.

The published review included just three short paragraphs on the cost of alcohol-related harm. It noted that BERL’s figure, “or rather the methods used to generate it, have been criticised by some commentators” but that “it has been widely cited in the alcohol-harm research and policy space in New Zealand”. No particulars of the criticism were included, but the bibliography cited the work that coauthors and I had undertaken when I was on faculty in economics at the University of Canterbury.

So I dug into what had been included in the earlier drafts.

At first, the Ministry stonewalled completely – refusing everything. The Ombudsman intervened.

The released drafts included a five-page discussion of BERL’s cost-of-alcohol figure, about three and a half pages of which summarised our previous coauthored critique of the BERL figure. We had found that perhaps 20% of BERL’s number might be defensible using a more standard economic method, and after correcting for some double-counting, but that even that figure would be unreliable.

An early draft of the review reminded readers that BERL’s figure included double-counting, as well as drinkers’ spending on their own alcohol: issues that will be familiar to Newsroom readers.

The draft report noted that “Some of these issues are related to the fundamental differences between an economic approach and a public health approach (e.g., exclusion of private costs), and some are clearly methodological flaws (e.g., double counting).”

None of those warnings made it into the final Stage 1 review.

Tracked comments from review rounds give some indication as to why.

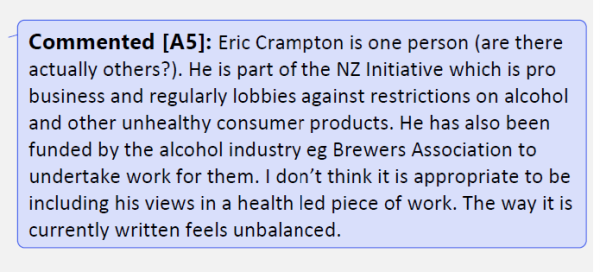

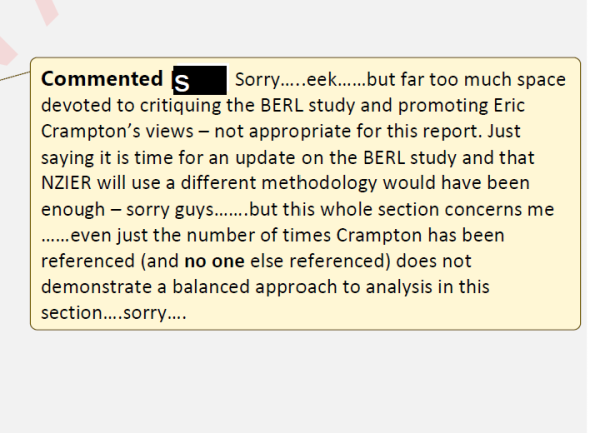

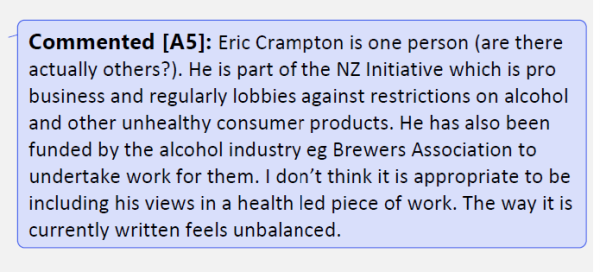

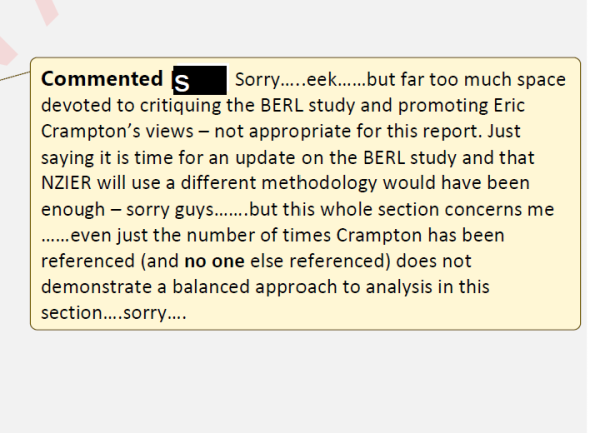

Feedback from the National Public Health Service (author identified only as A5) suggested deep unfamiliarity with the critique of BERL’s work, and hostility toward alternative approaches.

They misunderstood how BERL had skewed the health cost figure in its report, criticised me personally, and then suggested it is unbalanced to rely solely on my critique.

Feedback from a reviewer at the Ministry was about as generous.

I am not sure how many critiques of a consultancy paper they might expect in a small country. But I cannot take sole credit: Matthew Burgess and Brad Taylor were coauthors. In any case, a critique should stand or fall on its merits, not on the identity of its author. One might have hoped that the Ministry would want the figures on which they rely to be robust. But that would be to misunderstand the public sector.

Instead, a reasonable summary of the problems in BERL’s cost figure was expunged from the published review.

This does not increase confidence in the Levy Review process. What was to have been an independent review instead had its conclusions shifted in line with the biases of the Ministry.

It took over half a year of ongoing OIA requests, interventions, and a bit of luck to see how the Stage 1 Review was mangled, and what the independent reviewers had really found.

I do not look forward to Stage 2’s release.

The bottom line remains, as always, that interventions are warranted if they prove cost-effective. Tallies of the overall social cost, large or small, are not helpful to that end. But they are helpful in lobbying for more action in an area, with a large number being used as prima facie justification.

It’s a shame that the Public Health Agency seems keener on using large and unsound numbers to whet appetites for its preferred policies than on being a faithful advisor to its Minister and servant of the broader public.

If the Alcohol Levy Fund was used to pay for the review, I do not think that anyone who has contributed to that fund through their purchases should be happy about it.

Dr Eric Crampton is Chief Economist at the New Zealand Initiative. This article was first published HERE

What matters is cost-effectiveness. And the Alcohol Levy is meant to fund those kinds of cost-effective interventions.

There are a few more things that I think we should all be able to agree on. But if I don’t foreshadow the controversial parts, there is always a risk that people will stop reading. So here goes.

I have finally received a set of documents following Official Information Act requests that have been in progress since September 2023. It took the Ombudsman’s intervention.

The documents show that the initial scope for the independent review into the alcohol levy was partially motivated by a measure of the social cost of alcohol developed by BERL. As one of the consultants producing the report pointed out in an extensive critique, that measure, and the figures it produces, are flawed. But that critique was removed from the final report.

All in all, it looks like the Ministry of Health wants to promote a flawed and inflated measure of the social cost of alcohol to help it lobby for higher alcohol excise and for a higher levy.

This matters. The Ministry advises the Minister. The Minister makes decisions. If the Ministry ensured the deletion of material from a commissioned report contrary to the Ministry’s preferred view, that is a problem. It would be unbecoming of a Ministry presenting itself as a helpful servant to the Minister’s policy deliberations.

Alcohol faces two ‘taxes’. The government collects excise on alcohol that goes into government general revenues. It also collects a levy on alcohol that funds the Alcohol Levy Fund, used for harm-reduction activities by the Ministry of Health’s Health Promotion Agency.

Excise is $64.57 per litre of pure alcohol in spirits, meaning that $18.08 of the $56.99 price of a 700mL bottle of Kraken Rum (40% alcohol) is excise. The same $18.08 would apply on any 700mL bottle of 40% spirits, whether the cheapest vodka or the most expensive rare whisky: excise depends only on the quantity of pure alcohol in the bottle, but with a higher charge on spirits than on beer or wine. On 1 July, excise increases to $67.22 per litre of pure alcohol.

The Levy is much lower than excise. On spirits, it is currently about $0.13 per litre of pure alcohol – or about 4 cents on that bottle of rum.

The two charges serve different purposes.

If government wants to reduce overall alcohol consumption, or to raise revenue to offset its costs to the public health system or to police, a price instrument like excise is appropriate.

The best metastudy I have seen suggests that a 10% increase in the price of alcohol reduces overall consumption by about 4.4%, but only reduces heavy drinkers’ consumption by 2.8%.

This illustrates what a cumbersome tool excise is for dealing with harmful consumption. The person who drinks a bottle of whisky per day pays the same amount of excise, per bottle, as the person who drinks a bottle of whisky per year.

So, even if there were some way of getting a ‘right’ level of excise, on average, it would always overcharge harmless drinkers while undercharging those who cause harm.

In any case, the revenue raised by alcohol excise is not set aside for extra nighttime shifts for police or for accident and emergency departments.

Policy cannot solely rely on price measures like excise for addressing harms. It would be like trying to deal with street-racing and ram-raids by increasing petrol excise. In principle, there could be an excise level that would make street-racing unaffordable. But it wouldn’t be a good solution. It would impose too great a cost on those whose consumption is harmless.

The much-smaller levy, by contrast, directly funds harm-reduction programmes. And the government has been reviewing the levy. The Stage 1 Rapid Review was published in July 2023.

The Stage 1 Rapid Review

Unfortunately, we do not yet know whether any of the Levy’s funded projects are cost-effective.

The Stage One review noted that it was “not possible to quantify to what extent current levy investments reduce alcohol-related harm in the timeframe and with the material made available in stage 1 of this review.”

From the released documents, this appears to have been a down-scoping from the original work.

Chapter 5 of the Stage 1 Rapid Review was to have been titled “Effectiveness of harm reduction interventions”, with subsections on projects in health promotion, health protection, and community investment.

That was consistent with the original review scope, which included consideration of “the total levy fund and its impact on alcohol harm generally”.

In late February, a Manager for Alcohol Policy & Advice suggested revising the chapter heading to Evidence for harm reduction interventions, noting that it “is a slightly broader focus and would not preclude inclusion of evidence for effectiveness where this is available”.

Perhaps more detail on effectiveness of funded work will appear in the Stage Two review, reportedly due sometime this week. The Stage One review prudently recommended against increases in the alcohol levy until better evidence could be mustered.

Nevertheless, new alcohol levy rates were announced last week, taking effect from 1 July – an increase to $0.19 per litre levy on spirits.

It surely would have been better for public evidence of effectiveness to have preceded the levy announcement.

The Stage 1 Review and the Social Cost of Alcohol

The Review’s treatment of the overall social cost of alcohol was more worrying.

The initial scope for the review repeatedly highlighted BERL’s measure of the social cost of alcohol: $7.8 billion. BERL’s figure was cited in the purpose statement for the consultancy services order – it helped in motivating the review.

The Stage 1 review was meant to assess the social cost figure.

The published review included just three short paragraphs on the cost of alcohol-related harm. It noted that BERL’s figure, “or rather the methods used to generate it, have been criticised by some commentators” but that “it has been widely cited in the alcohol-harm research and policy space in New Zealand”. No particulars of the criticism were included, but the bibliography cited the work that coauthors and I had undertaken when I was on faculty in economics at the University of Canterbury.

So I dug into what had been included in the earlier drafts.

At first, the Ministry stonewalled completely – refusing everything. The Ombudsman intervened.

The released drafts included a five-page discussion of BERL’s cost-of-alcohol figure, about three and a half pages of which summarised our previous coauthored critique of the BERL figure. We had found that perhaps 20% of BERL’s number might be defensible using a more standard economic method, and after correcting for some double-counting, but that even that figure would be unreliable.

An early draft of the review reminded readers that BERL’s figure included double-counting, as well as drinkers’ spending on their own alcohol: issues that will be familiar to Newsroom readers.

The draft report noted that “Some of these issues are related to the fundamental differences between an economic approach and a public health approach (e.g., exclusion of private costs), and some are clearly methodological flaws (e.g., double counting).”

None of those warnings made it into the final Stage 1 review.

Tracked comments from review rounds give some indication as to why.

Feedback from the National Public Health Service (author identified only as A5) suggested deep unfamiliarity with the critique of BERL’s work, and hostility toward alternative approaches.

They misunderstood how BERL had skewed the health cost figure in its report, criticised me personally, and then suggested it is unbalanced to rely solely on my critique.

Feedback from a reviewer at the Ministry was about as generous.

I am not sure how many critiques of a consultancy paper they might expect in a small country. But I cannot take sole credit: Matthew Burgess and Brad Taylor were coauthors. In any case, a critique should stand or fall on its merits, not on the identity of its author. One might have hoped that the Ministry would want the figures on which they rely to be robust. But that would be to misunderstand the public sector.

Instead, a reasonable summary of the problems in BERL’s cost figure was expunged from the published review.

This does not increase confidence in the Levy Review process. What was to have been an independent review instead had its conclusions shifted in line with the biases of the Ministry.

It took over half a year of ongoing OIA requests, interventions, and a bit of luck to see how the Stage 1 Review was mangled, and what the independent reviewers had really found.

I do not look forward to Stage 2’s release.

The bottom line remains, as always, that interventions are warranted if they prove cost-effective. Tallies of the overall social cost, large or small, are not helpful to that end. But they are helpful in lobbying for more action in an area, with a large number being used as prima facie justification.

It’s a shame that the Public Health Agency seems keener on using large and unsound numbers to whet appetites for its preferred policies than on being a faithful advisor to its Minister and servant of the broader public.

If the Alcohol Levy Fund was used to pay for the review, I do not think that anyone who has contributed to that fund through their purchases should be happy about it.

Dr Eric Crampton is Chief Economist at the New Zealand Initiative. This article was first published HERE

3 comments:

Solely isolating alcohol, and trying to lay blame on its use and cost to society, is an absolute smoke screen.

Drugs are an unquantifiable component of today’s society. Until we have a police force capable of dismantling gangs, a judiciary prepared to put behind bars those that pedal drugs and we stop telling drug users to get their drugs tested before use, our road carnage, mental health statistics and violence will steadily increase.

Hardly a brief read BUT when added to the monster of inept Health Ministry spending outlined by the Taxpyers Union this week on Breaking Views the Health Ministry bureauocracy is shown very poorly.

Most people see the Health Budget appropriated by Govt in the light of hospital, health care and staff, however the back room blobs should cringe in embarrassment from their misconduct in office .

It seems that the long March through the institutions is really paying off. We now have a ‘public service’ in name only. We cannot expect unbiased, rational and reasoned thinking from the great majority when there is a tempting opportunity to insert their own ideological point of view. This is going to take courage, determination and ruthlessness to fix, if it is not actually too late to make a difference.

Post a Comment

Thank you for joining the discussion. Breaking Views welcomes respectful contributions that enrich the debate. Please ensure your comments are not defamatory, derogatory or disruptive. We appreciate your cooperation.