Local ratepayers face ballooning increases

Across New Zealand, average council rates have surged at more than twice the pace of inflation over the last three years. Fresh analysis reveals this surge in council rates, which makes central government look frugal by comparison.

Ratepayers are footing the bill not just for pipes and rubbish, but for ideological experiments including Māori wards imposed without voter petitions or referenda, climate action plans of debatable value, ballooning communications teams, and a culture of consultants who answer to no one.

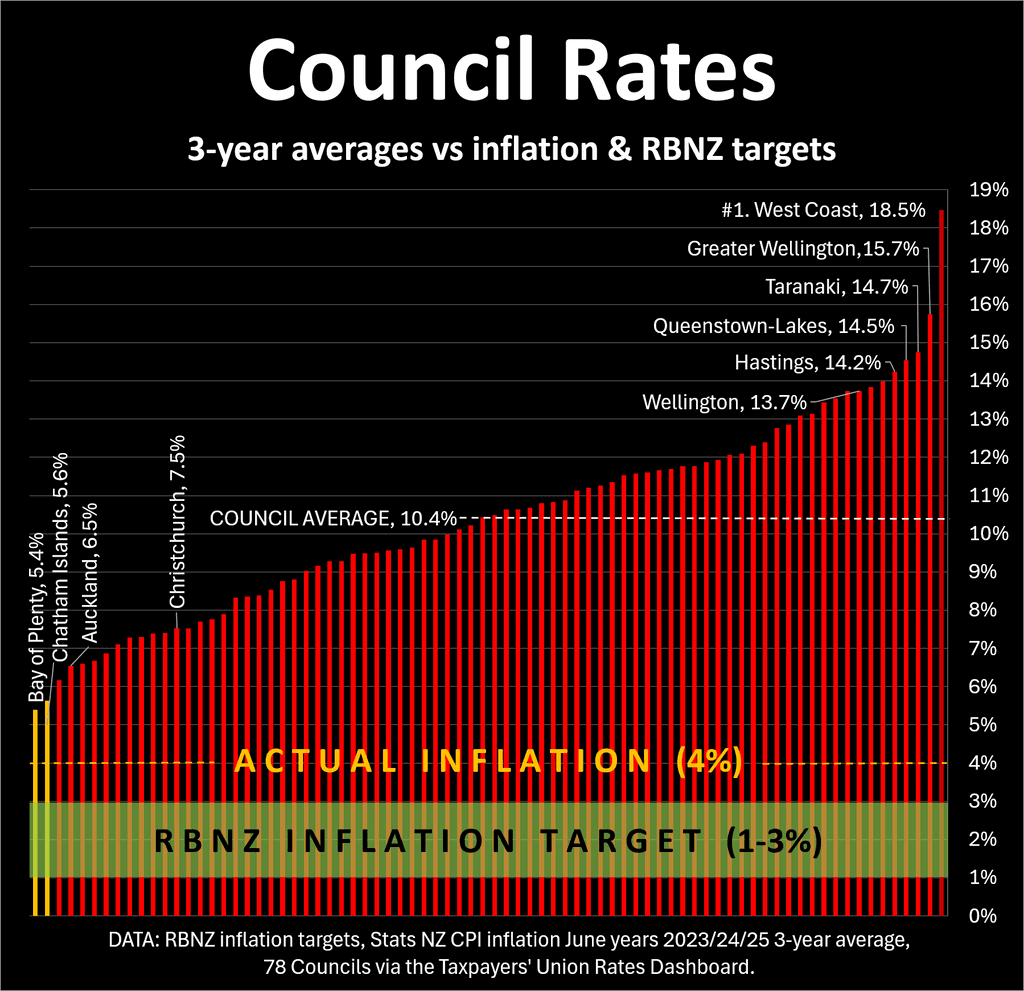

Data compiled by the Taxpayers’ Union shows average total rate increases of 34% across 78 councils over the past three years, or 10.4% per year with the compounding effect removed. This is 2.5 times the average rate of inflation of 4.0% over the same time period.

Compared to the Reserve Bank’s inflation target of 1–3% a year, rates have soared 3.5 to 10 times higher.

In plain terms, households are paying councils like a cost-of-living crisis on steroids.

Three years, 78 councils, one trend

Over the 2023, 2024, and 2025 financial years to June, inflation averaged 4.0% per year. Yet councils collectively jacked up rates by more than 10% on average per year.

The West Coast led the pack with increases totalling nearly 66% over three years. Greater Wellington followed on with nearly 55%, then Taranaki at around 51%, Queenstown-Lakes at just over 50%, and Hastings at nearly 49%.

Each of these five lifted rates by about 10 percentage points or more above inflation, per year, (4% vs 14.2%+), effectively creating their own “super-tax” well out of line with household budgets.

At the other end, Bay of Plenty (5.4%) and the Chatham Islands (5.6%) were the only councils out of 78 to keep rate hikes within two points of actual inflation, per year. As a comparison, Auckland rates averaged an increase of 6.5% per year over this time (fourth lowest), but are set to rise 7.9% next year.

Election timing couldn’t be sharper

With voting closing this Saturday at noon, this data lands at the worst possible time for incumbent councillors. Ratepayers feeling squeezed by food, fuel, and mortgage costs may not forgive councils for compounding the pressure.

“West Coast ratepayers have faced average yearly hikes of 18.5%, the sharpest in the country. In Taranaki, where voters are already wary over resource consent politics, rate hikes of 14.7% will add to the perception that councils have lost touch. Greater Wellington and Queenstown-Lakes, both with complex infrastructure and housing challenges, may find their excuses cut little ice with voters staring at double-digit bills.

And unlike previous decades, there’s no offsetting comfort from rising property values. Instead, many homeowners are being squeezed from both sides: higher rates on one hand, and falling house valuations on the other. It’s a hit that leaves households poorer, not just in income but in wealth.

The government is expected to decide on rate caps before the end of the year, with its latest quarterly action plan including a directive to “take policy decisions” on the issue.

The Centrist is a new online news platform that strives to provide a balance to the public debate - where this article was sourced.

Data compiled by the Taxpayers’ Union shows average total rate increases of 34% across 78 councils over the past three years, or 10.4% per year with the compounding effect removed. This is 2.5 times the average rate of inflation of 4.0% over the same time period.

Compared to the Reserve Bank’s inflation target of 1–3% a year, rates have soared 3.5 to 10 times higher.

In plain terms, households are paying councils like a cost-of-living crisis on steroids.

Three years, 78 councils, one trend

Over the 2023, 2024, and 2025 financial years to June, inflation averaged 4.0% per year. Yet councils collectively jacked up rates by more than 10% on average per year.

The West Coast led the pack with increases totalling nearly 66% over three years. Greater Wellington followed on with nearly 55%, then Taranaki at around 51%, Queenstown-Lakes at just over 50%, and Hastings at nearly 49%.

Each of these five lifted rates by about 10 percentage points or more above inflation, per year, (4% vs 14.2%+), effectively creating their own “super-tax” well out of line with household budgets.

At the other end, Bay of Plenty (5.4%) and the Chatham Islands (5.6%) were the only councils out of 78 to keep rate hikes within two points of actual inflation, per year. As a comparison, Auckland rates averaged an increase of 6.5% per year over this time (fourth lowest), but are set to rise 7.9% next year.

The gap that can’t be explained away

Councils often argue that “local inflation” differs from national measures, citing construction costs, staff pay, or interest on debt. But the gap between a Reserve Bank target of 1–3% and actual inflation of 4% and some councils increasing rates by 14–18% is extremely wide.

Even allowing for high infrastructure costs, a consistent nationwide pattern of increases 2–4 times higher than inflation suggests a culture of spend-now, justify-later. The phrase “council culture” may prove the most fitting description: a combination of bureaucratic empire-building, political timidity over cuts, and a tendency to treat ratepayers as a bottomless well.

Councils often argue that “local inflation” differs from national measures, citing construction costs, staff pay, or interest on debt. But the gap between a Reserve Bank target of 1–3% and actual inflation of 4% and some councils increasing rates by 14–18% is extremely wide.

Even allowing for high infrastructure costs, a consistent nationwide pattern of increases 2–4 times higher than inflation suggests a culture of spend-now, justify-later. The phrase “council culture” may prove the most fitting description: a combination of bureaucratic empire-building, political timidity over cuts, and a tendency to treat ratepayers as a bottomless well.

Election timing couldn’t be sharper

With voting closing this Saturday at noon, this data lands at the worst possible time for incumbent councillors. Ratepayers feeling squeezed by food, fuel, and mortgage costs may not forgive councils for compounding the pressure.

“West Coast ratepayers have faced average yearly hikes of 18.5%, the sharpest in the country. In Taranaki, where voters are already wary over resource consent politics, rate hikes of 14.7% will add to the perception that councils have lost touch. Greater Wellington and Queenstown-Lakes, both with complex infrastructure and housing challenges, may find their excuses cut little ice with voters staring at double-digit bills.

And unlike previous decades, there’s no offsetting comfort from rising property values. Instead, many homeowners are being squeezed from both sides: higher rates on one hand, and falling house valuations on the other. It’s a hit that leaves households poorer, not just in income but in wealth.

The government is expected to decide on rate caps before the end of the year, with its latest quarterly action plan including a directive to “take policy decisions” on the issue.

The Centrist is a new online news platform that strives to provide a balance to the public debate - where this article was sourced.

3 comments:

As a fellow pensioner said a few days ago.

'I scrape and save to pay my rates to a council that won't scrape and save'.

Ameni

It's time Central Government reinstated the list of compulsory core services to be delivered by local Government. There is far too much wriggle-room for vanity projects under the current Local Government Act. I live in North Taranaki where we have a District Council hell-bent on spending millions of dollars on building a concrete path from Bell Block to Waitara. Why is that, when new suburbs are still relying on septic tanks for sewage disposal? And who paid for that ridiculous Maori themed new scenic lookout at the airport? Tightly restraining the role of local bodies will force them to focus on the important stuff.

Local government has become a law unto itself and is corrupted with a culture of demanding extortionate rates.

These nefarious feudal empires need to be reined in.

It can start with removing anything to do with "treaty partnership" in whatever overriding policies they set.

Post a Comment

Thank you for joining the discussion. Breaking Views welcomes respectful contributions that enrich the debate. Please ensure your comments are not defamatory, derogatory or disruptive. We appreciate your cooperation.