As New York City Mayor-elect Zohran Mamdani prepares to take office, tax-happy progressive groups are eager to let you know that the idea that rich people move because of taxes is all a big myth. There are no consequences to raising taxes on rich people, they argue, because rich people will be rich no matter what.

It’s a pretty picture, and a convenient one for those who have never met anything economically productive that they didn’t want to tax. The only problem is that the data proves it just isn’t true.

The latest media blitz comes in response to Mamdani’s campaign proposals to raise the income tax rate for top earners in the city from 3.9 percent to 5.9 percent. That’s in addition to statewide rates, which currently run as high as 10.9 percent. That means that, under Mamdani’s proposal, the wealthiest Big Apple residents would face state and local income taxes as high as 16.8 percent, even before federal taxes.

But never fear, say progressive groups such as Patriotic Millionaires — Zohran can tax to his heart’s content without fear of millionaire tax flight. They attempt to fortify their claims with research by the Center for Budget and Policy Priorities and tax-happy academics who make points that are technically true, yet entirely miss the point.

For instance, Patriotic Millionaires cites data showing that the millionaire population in New York grew in the wake of recent tax increases on the wealthy at the state level. But of course it did — the population of millionaires is constantly growing across the country due to economic growth and inflation. The more important thing, as the New York-based Empire Center shows, is that New York’s share of the nationwide millionaire population has dropped precipitously in recent years, from 12.7 percent in 2010 to 8.7 percent in 2022.

Others point to a spike in sales in the New York City luxury real estate market to suggest that “there is no Mamdani effect.” But that actually is an indication of the ongoing exodus, not a rebuttal. The New York City housing market has such a severe shortage of housing that when some wealthy New Yorkers pack up and leave, it’s no surprise that remaining millionaires snap up those luxury properties quickly. It’s no coincidence that inquiries from New Yorkers to the Miami Beach Ritz-Carlton for beachfront penthouses worth $10 million or more nearly tripled in the wake of Mamdani’s election.

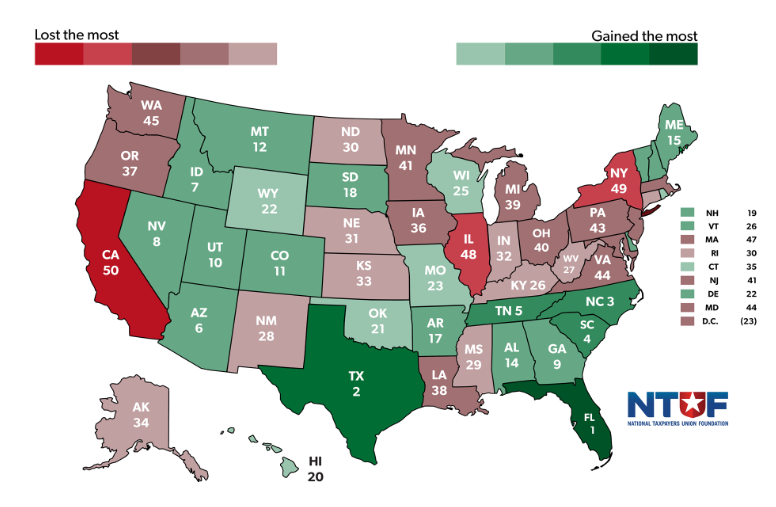

Looking at the impact of net migration, the highest-tax states lose big among the wealthy every year. In the most recent IRS data, New York lost the second-most wealthy residents (shocker: California lost the most). On the other hand, Florida gained the most new wealthy residents from other states, followed by Texas.

But never fear, say progressive groups such as Patriotic Millionaires — Zohran can tax to his heart’s content without fear of millionaire tax flight. They attempt to fortify their claims with research by the Center for Budget and Policy Priorities and tax-happy academics who make points that are technically true, yet entirely miss the point.

For instance, Patriotic Millionaires cites data showing that the millionaire population in New York grew in the wake of recent tax increases on the wealthy at the state level. But of course it did — the population of millionaires is constantly growing across the country due to economic growth and inflation. The more important thing, as the New York-based Empire Center shows, is that New York’s share of the nationwide millionaire population has dropped precipitously in recent years, from 12.7 percent in 2010 to 8.7 percent in 2022.

Others point to a spike in sales in the New York City luxury real estate market to suggest that “there is no Mamdani effect.” But that actually is an indication of the ongoing exodus, not a rebuttal. The New York City housing market has such a severe shortage of housing that when some wealthy New Yorkers pack up and leave, it’s no surprise that remaining millionaires snap up those luxury properties quickly. It’s no coincidence that inquiries from New Yorkers to the Miami Beach Ritz-Carlton for beachfront penthouses worth $10 million or more nearly tripled in the wake of Mamdani’s election.

Looking at the impact of net migration, the highest-tax states lose big among the wealthy every year. In the most recent IRS data, New York lost the second-most wealthy residents (shocker: California lost the most). On the other hand, Florida gained the most new wealthy residents from other states, followed by Texas.

If pressed further, progressive tax advocates may fall back on another true yet ultimately irrelevant point: that specific tax increases, generally speaking, raise more money than they lose in tax flight. And, indeed, Zohran’s two-percent income tax surcharge would likely leave the city with more revenue in the short term. But the cost comes in the long term, and has been coming for spending-addicted cities and states for some time.

The National Taxpayers Union Foundation estimates that New York will have $3.8 billion less tax revenue to work with at both the state and local levels in 2025 because of out-migration. New York and New York City are losing that revenue year after year, shrinking the tax base and making future spending binges even harder to finance.

As the cash cows in the top income brackets leave for greener pastures, there are only two options for politicians who treat the idea of “reining in spending” as an odd foreign custom. One is to increase taxes further on the wealthier New Yorkers who are left, which only exacerbates the problem. The other is to start to shift more and more of that tax burden onto the middle class.

And guess what? A lot of those wealthy emigrants take their businesses — employers who provide jobs and pay a lot of tax revenue — with them. No state is losing firms to other states faster than New York.

Even long-time New York City staples are looking elsewhere, as Mamdani’s election has managed to accelerate the already exploding growth of the Dallas counterpart to Wall Street (affectionately known as “Y’all Street”). Big names such as Goldman Sachs and JPMorgan Chase continue to shift more and more of their operations to the Lone Star state, and Texas now boasts more jobs in the financial services sector than New York does.

Progressives should not stick their heads in the sand about the consequences of their policies. Many wealthy New Yorkers will choose to stay after yet another tax hike from Mayor Mamdani, and some of those will stay after the next tax hike as well. But with death by a thousand cuts, it’s the steady bleeding that kills you.

Andrew Wilford is the Director of the Interstate Commerce Initiative and a Senior Policy Analyst at the National Taxpayers Union Foundation. This article was sourced HERE

The National Taxpayers Union Foundation estimates that New York will have $3.8 billion less tax revenue to work with at both the state and local levels in 2025 because of out-migration. New York and New York City are losing that revenue year after year, shrinking the tax base and making future spending binges even harder to finance.

As the cash cows in the top income brackets leave for greener pastures, there are only two options for politicians who treat the idea of “reining in spending” as an odd foreign custom. One is to increase taxes further on the wealthier New Yorkers who are left, which only exacerbates the problem. The other is to start to shift more and more of that tax burden onto the middle class.

And guess what? A lot of those wealthy emigrants take their businesses — employers who provide jobs and pay a lot of tax revenue — with them. No state is losing firms to other states faster than New York.

Even long-time New York City staples are looking elsewhere, as Mamdani’s election has managed to accelerate the already exploding growth of the Dallas counterpart to Wall Street (affectionately known as “Y’all Street”). Big names such as Goldman Sachs and JPMorgan Chase continue to shift more and more of their operations to the Lone Star state, and Texas now boasts more jobs in the financial services sector than New York does.

Progressives should not stick their heads in the sand about the consequences of their policies. Many wealthy New Yorkers will choose to stay after yet another tax hike from Mayor Mamdani, and some of those will stay after the next tax hike as well. But with death by a thousand cuts, it’s the steady bleeding that kills you.

Andrew Wilford is the Director of the Interstate Commerce Initiative and a Senior Policy Analyst at the National Taxpayers Union Foundation. This article was sourced HERE

3 comments:

Tax rates are far from the only factor affecting interstate migration decisions, and many economists say the link between taxes and moving is overstated: “Grossly exaggerated,” in the words of Michael Mazerov of the Center on Budget and Policy Priorities. Researchers have found that costs of living, job opportunities, recreation, crime and weather and climate have a major influence on where people move.

This is just the usual scaremongering, people have been fostering fear of millionaires leaving New York back when I was still at uni. It hasn’t happened yet, and even if it did, so what? We might be more affordable housing? Better education? A more equitable state?

Come on, Andrew, you must have some more original scare tactics than this Dunlop retread.

Rich people didn’t get rich by helping their fellow man. Elon Musk could fix poverty tomorrow if he put his mind to it, but he’d rather ignore his kids and take pot-shots at vulnerable minorities.

You can tell how scared the oligarchs are of people like Mamdani, who show that we can do something about the current state of affairs…the right-wing has gotten in fifth gear scaremongering mode!

Good grief, you have no idea have you? Musk makes cars, that gives jobs to thousands and thousands of people, he sends satellites into orbit that will make communication cheaper for millions and yet you say he’s just greedy.

Western civilisation has enriched the lives of billions of people, we live in luxury unknown to our grandparents. The poorest people in NZ have access to plentiful food, cheap transport, medical treatment and entertainment unknown to poor people 100 years ago.

Post a Comment

Thank you for joining the discussion. Breaking Views welcomes respectful contributions that enrich the debate. Please ensure your comments are not defamatory, derogatory or disruptive. We appreciate your cooperation.