This week, headline after headline bitched about the new 'free' school lunch programme. Principals apparently compared the meals to 'dog food'. There were numerous teething problems with delivery. KidsCan jumped on the bandwagon to promote child poverty and useless government yet again.

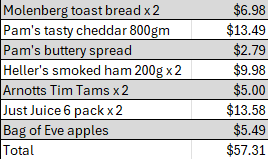

It beggars belief really. Parents are already paid cash every week to help them take care of their children. Family Tax Credits are for low-income or beneficiary families tapering off as a parent's income increases. Before I lay those out, here's a cost breakdown of a lunch I would make and eat myself (maybe omitting the biscuits): a couple of ham and cheese Molenberg sandwiches, a couple of Tim Tams and an apple. Throw in a Just Juice and the weekly cost, purchased from Pak'nSave, for two children, would be $57.31.

Broken down:

Broken down:

Obviously, a couple of vegemite sandwiches and plain biscuits would cost a lot less.

Anyway, here's what a low-income family with two children receives weekly to spend on their children's needs:

Click to view

School lunches are already well-catered for with $261.86 cash assistance.

Parents are double-dipping.

The complicit schools cry "hungry children can't learn" forcing the state to step in and giving lazy parents ample opportunity to renege on their own obligation.

If the parent refuses to provide the lunch that the government has already paid for then the cost should be deducted from their family tax credits.

If parents are allowed to assume less and less responsibility for their children, no good will come of it. The balance gets ever more tipped towards all rights and no responsibilities. As a society we need to be heading in the other direction.

When Family Tax Credits were introduced, National and ACT opposed them. In government, they accepted them. When free school lunches were suggested National and ACT opposed. Now a decade later, National and ACT accept them.

Look how far we have traveled in a short space of time.

While school lunches may seem small-beer to some, they are a marker of a society steadily moving away from personal responsibility. And that's not trivial.

Lindsay Mitchell is a welfare commentator who blogs HERE - where this article was sourced.

11 comments:

I am in total agreement with the last sentence.

Having a child should at the very least entail a preparedness to look after it. It was a matter if choice bringing it into the world. If you don't look after it, you are being negligent and the State should step in not by taking over the responsibility you have chosen but by holding you to your implied pledge.

That's how it works for people who have dogs, isn't it? Having a dog is a free choice but should you acquire one you must look after the animal or be done for negligence.

I want to see both negligent dog owners and parents prosecuted.

In contrast, the tribal ethos is to share child rearing amongst the various persons concerned from familoy and a wider circle.

"It Takes a Village to Rear the Child " is the African proverb. Maori culture operates kin this way. Has NZ already become this sort of society?

I agree that parents shouldn't double dip, but the best way is to feed the kids (the most urgent need) then massively cut the benefits.

Remove the biscuits and juice(its just sugar) and buy budget brand bread, colby cheese and luncheon meat. That brings the cost down considerably. If the reason the kids aren't getting lunch is because the parents are lazy, then prosecute them for child abuse.

For decades I cut myself six bread, butter and jam or honey sandwiches. Prior had similar at school. I am well past 3 score and ten, no obesity or diabetes, ride a bike most days, generally very active. Presumably milk in tea contributed. At PakNSav bread is $1.15 loaf jam and peanut butter about 70c per 100 grams.. Nowadays there are opportunists poised everywhere to make a buck.

Sadly, I wonder if many kids would throw their healthier lunches away. For more than a few the food groups are McDonalds, KFC, Burger King and Pizza Hit or pies or anything with fries. I was doing security at a centre city (provincial) site a few years ago (we have trouble there) and it was about 4.30pm. A girl about 14 wondered where she could go to buy a meal. I mentioned (she had $20) a couple of good noodle, rice and so forth , Thai, places, not expensive , round the corner. Her reply was: I don't want that s..t, I want proper food like a pie.'' Bunking school that day too and ticked all the stereotype boxes in other aspects. When McDonalds moved out of the food court nearby our problem kids and teens drifted away for part of the day because the nearest branded takeaways were a fair distance walk away. Trouble briefly moved there.

As the saying goes "If you give a person a fish, they will be hungry tomorrow. If you teach a person to fish, they will be richer forever"

Except now its be given a fish which has to be the right kind and size of fish plus cooked according to my needs otherwise I'll complain that my 'free' (well taxpayer funded) fish isn't good enough and all the non-thinking media will leap upon it and make it a headline about poorly cooked bad fish being fed to the nation.

So if the parents were paid cash to allow them to purchase these lunches they would pay income tax, as is the case for every other cash benifit. How come they aren't required to pay tax on the "free" meals which is just a different way of delivering the benefit. If my employer paid me in kind, the IRD would not hesitate to tax me. These parents are therefore not just double-dipping. They are triple-dipping because the rest of us have to feed our kids out of tax-paid income.

School lunch, food for the pit bull, or another tat ?

Tough choices

Annoying though it is, I concede that until attitudes around parenting change for the better (in certain circles) it might be best that us tax payers get some basic food (v crap) into the less fortunate children. I know that some of it is a rort, and the lack of gratitude is infuriating, but I consider that potentially benefits outweigh costs - if managed well.

When I was teaching at a NZ Intermediate school in 2010, I overheard a chubby, slightly over-weight Maori boy encouraging his buddy to come with him to receive a free school breakfast before classes began.

His buddy replied, "Nah, I've already had breakfast".

The first lad said, "So have I, it doesn't matter, it's free, come on".

Both boys joined the queue.

Enough said.

Post a Comment

Thank you for joining the discussion. Breaking Views welcomes respectful contributions that enrich the debate. Please ensure your comments are not defamatory, derogatory or disruptive. We appreciate your cooperation.